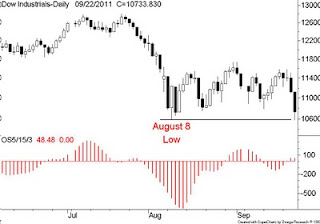

Now the good news – so far The Dow internals (breadth) are today in better shape than back in August 8 At quick look at the Dow 30 components and counting how many are above or below their relative August 8 lows As of 2.50 pm September 22, 2011 – I count only 8 (eight) components trading under their relative August 8 lows. The symbols: AA, BAC, CAT, DD, HPQ, JPM, MMM and TRV - Total 8 - All the rest, a total of 22 (twenty two) components are above their respective August 8 lows

Friday, September 23, 2011

Saved by the DOW

First the bad news: The big technical test is for the August 8 lows to hold – see the inter-day DOW chart below. The August 8 low is Dow 10604 and so at 10680 we are at the tipping point. Can we recover from here? See the breadth observation below

Wednesday, September 21, 2011

On Selling RIM

A few posts ago I mused that Research In Motion at $23 was almost a joke – unless the market knew something we don’t know - but I don’t think RIM is going bust anytime soon. The technical view of RIM is one of the worst big cap train wrecks I have ever seen. RIM was so bad it had to be good

A few weeks later there was some technical good news on RIM based on a relative perform analysis on RIM vs. AAPL. In August RIM popped from $22 to over $32 then suddenly the torpedo and now right back to $22. Clearly the trade is not working and so I have three choices - sell, hold or add on to the position

Adding on is out because we never add to a losing position unless we planed the original buy in tranches. I won't sell yet just in case we are forming a double bottom. Note the slightly higher money flow lines. I will however sell on a weekly close below the August 8 low of $21.40 - see the daily RIM chart with the stop support line.

Tuesday, September 6, 2011

The August 8 Lows are Still Holding

The TSX Composite is still trading above support at the 11900 to 12000 level - see the weekly chart below. - Currently the simple 10-week moving average is too far below the simple 40-week moving average where these extreme deviations usually signal an over-sold condition or a pending reversal. Also the very slow stochastic has printed a trough at the over-sold 20 per cent level. The August 8 low is 11618 and should hold so don’t be a seller here

The Dow Industrials are still trading above support at the 10700 to 10900 level - see weekly chart below - Currently the 10 week MA has been below the 40 week moving average for 6-weeks and is setting up an over-sold condition or a pending reversal. We last saw this condition during the 2010 June – July correction. The very slow stochastic has printed a trough at the over-sold 20 per cent level. The August 8 low is 10589 and should hold so don’t be a seller here

Subscribe to:

Comments (Atom)