Join

me and Kevin Prins, Director of National Sales - BMO ETFs - at the Toronto

World MoneyShow Friday, October 30 at 1:30 pm as we discus ETFs and how they

can be selected to use natural sector rotation as a tool to move in and out of global

markets

Sector

selection takes advantage of natural stock market rotation due to the normal

business cycle which is led by the consumer followed by manufacturing and

finally the cyclical industries. When executed properly rotation allows you to

remain fully invested by over-weighting in the rising sectors and

under-weighting in the falling sectors.

If

you wish to adopt this strategy the first step is to recognise the 10 unique

and distinct stock sectors (or asset classes) as set out by the index people at

Standard & Poor's. They are Energy, Materials, Industrials, Consumer

Discretionary, Consumer Staples, Health Care, Financials, Information

Technology, Telecommunications Services and Utilities

The

best way to understand the rotation order is to picture a 10-car roller coaster

with the financial, utility and consumer sectors riding in the front two or

three cars. We call this the front end of the market. The next three or four cars will be occupied

by the telecom, technology and industrial sectors. We refer to these as the

middle of the market - and finally riding in the last few cars would be the

energy and materials group which we refer to as the back end of the market.

Picture

now this 10-car train slowly climbing to the crest of the ride (a bull market)

and eventually the front end slipping over the crest and now falling. So now we

have a condition with occupants in the front end screaming in fear while the

middle and back end cars still are enjoying the climb. Eventually the middle

cars crest and you know the rest.

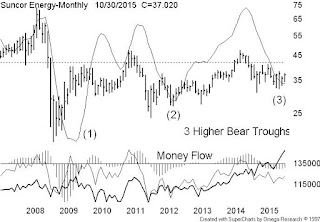

The global markets also are also driven by the forces

of rotation – our chart displays the lead – lag relationship between the BMO (ZUH)

and the BMO (ZEO)