His latest piece - last updated on Saturday, Mar. 27, 2010 “Almost all the things you don't like about mutual funds have been fixed in a new investing product called the actively managed exchange-traded fund.” I was curious to see his logic to support his profound “mutual funds have been fixed” claim.

Carrick leads with – “But now there's a different type of ETF – one that does exactly what conventional mutual funds do, but without the high cost and impediments to convenient buying and selling.

Question: Don’t all ETFs avoid the high cost and impediments to convenient buying and selling?

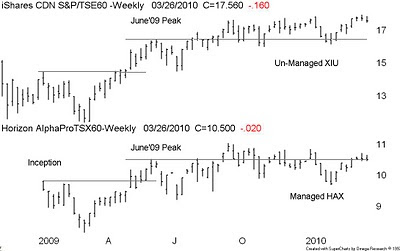

Carrick: - “Actively managed ETFs were introduced in Canada by Horizons AlphaPro in early 2009 and the reception was unenthusiastic. I wrote a column dissing them on the basis that many fund managers can't beat their benchmark indexes, a point that highlights the benefit of the traditional index-tracking ETF.

Question: So how come 12-months latter we now decide managers can beat their benchmark indexes?

Carrick: - “The actively managed ETF market has evolved in 2010, and so has my view. With some quality managers being recruited to run these ETFs, I think they have the potential to be one of the most significant retail investing developments in years.

Question: Aren’t these managers being recruited from the same fund industry that “needed to be fixed?”

Carrick: - “Subpar managers are easy to find in the mutual fund world – that's precisely why conventional index-tracking ETFs have become such a fast-growing product. But savvy investors know there are some managers who are worth putting to work in your portfolio. Actively managed ETFs are a smarter way to access these managers.

Question: If an active mutual fund manager is so good, why then work for less for an ETF manufacturer?

Carrick: - “Let's start with fees. The management expense ratios for five of the AlphaPro active ETFs is 1 per cent, while two others come in around 1.25 per cent. In addition, performance fees are charged if the funds beat specific benchmarks.

Question: How come Carrick fails to explain the 20% performance fee?

Carrick: - “A major reason why active ETFs cost less to own than mutual funds is that their fees do not include a component that is intended to compensate investment advisers for the counsel they provide clients. This so-called trailing commission accounts for one percentage point of the typical equity fund's MER and 0.5 points for the average bond fund.

Question: Is not a 1% trailer less than a 20% performance fee?

Carrick: - “Imagine you want to sell a fund with the market soaring at midday. You can do that with an actively managed ETF, whereas a fund exposes you to the risk that the market will pull back or even decline later in the day. When buying, you can take advantage of a dip to place your order.

Question: If the ETF is managed by a “quality manager”, how come we are now trading during “soaring at midday” and taking advantage of a dip to place your order? Are we not just to buy-and-hold and let the “quality manager” make those decisions?

Carrick: – “Because active ETFs are traded like stocks, you can use a limit order to set a ceiling on what you'll pay and a floor on what you'll accept when selling. You can also use a stop-loss order to liquidate your holding if the price falls through a certain threshold.”

Question: Are you suggesting we place restrictions such as ceilings and floors and stop losses on a “quality manager”?

Carrick: - “Here's a list of TSX-listed ETFs that use a manager to pick securities rather than following the traditional ETF strategy of tracking an index. All are part of the Horizons AlphaPro family.”

Question: If you can produce a list how come you don’t produce a track record?

By the way - Don Vialoux, Brooke Thackray, Dennis Gartman, Frank Mersch, Prakash Hariharan, Steve Rogers¸ Lyle Stein and Vito Maida are all sub-advisors to these products and not the fund managers as set out in the Carrick tables.

4 comments:

Thank you for another good article filled with points worth remembering.

Don't know whether it continues to be true, but there was a time when it was better to own shares of the Fund companies than the funds they sold. I believe that the Horizon Funds are a division of Jovian (JOV on the TSX). After a significant share consolidation last year, they seem to have bottomed and are breaking out. Any thoughts on this strategy and whether it is time for JOV to 'soar'?

Joe – that is a very good question because when you look at 10-years of trading history the owners of the publicly traded fund managers (the shareholders) have done better than the customers (the fund or unit buyers) and so I did take a look at Jovian Capital (JOV on the TSX) and see a neutral to poor technical picture.

Firstly is peer group – the other wealth managers and the banks have had a big run and are beginning to display some decay on a relative basis. In fact there are only three issuers in the sector displaying any sector out perform – Onex, Intact Financial and IGM Financial. Yesterday’s collapse of Sprott Inc is not a good omen. The other problem for JOV is the poor trading liquidity and the fact they are in a risky leveraged business and finally we are at the late stages of a bull market and the next bear will – one again, crush the sector.

Bill Carrigan

Hi Bill, can you please clarify on your comments to Joe that we are in the late stages of a bull market? I thought the average bull market runs 30 - 48 months (we are just 12 months into this one) and looking at the long term MA's (65 week) on the indices they are sloping up and price is well above. In addition, a high percentage of stocks are trading above their 200 day moving averages and out-pacing decliners.

Hello Student

Yes you are correct - the average bull is at least 30 months now we could argue the origin of the current bull was somewhere between Nov'08 and Mar'09. This bull is different because it is a rare Rebound Bull such as we had in 2003. The Rebound Bull will follow a Granddaddy Bear and is normally short and of great magnitude without any corrections - the following bear is also short and shallow with the next bull taking us to new highs - Bill Carrigan

Post a Comment