Today I am posting another tragic example of machines gone wild or squiggly line madness so common to-day. Our chart is a daily study of Suncor Energy using candlesticks accompanied by an RSI, Bollinger Bands, three moving averages, a MACD and a slow stochastic. At least 11 squiggly lines to ponder. The chart is a daily plot up to the close at $30.69 at May 26, 2010.

Now I never liked Suncor because it has been a persistent under performer through September 2009. I am also not a fan of the tar sands producers because their business models are cluttered with cost problems and environmental issues. Now aside from my personal negative bias I bought the stock for a trade - can you guess why?

I can see the RSI still trending downward, the price is running down a lower Bollinger Band, the price is below 3 moving averages, the MACD has not turned up yet and the slow stochastic has not quite curled up. Finally the candlestick plot has just issued a black bar. So why would I buy now?

Thursday, May 27, 2010

Thursday, May 20, 2010

Tea Leaves, Voodoo & Other Dark Forces (2)

A few posts ago I displayed a tragic example of machines gone wild or squiggly line madness so common to-day. The chart was a study of Teck Resources using candlesticks accompanied by an RSI, Bollinger Bands, three moving averages, a MACD and a slow stochastic. At least 11 squiggly lines to ponder. The chart was a daily plot up to the close at $35.64 May 14, 2010.

The squiggly line signals were mixed with the RSI trying to generate a bullish positive divergence signal, the plot was into support at the lower Bollinger Band and we seemed to be into support at the 200 day MA. The MACD was into over-sold territory and the Slow Stochastic was also trying t turn up and about to generate a bullish positive divergence buy signal.

Let us now look at a pure daily chart of Teck Resources at the close of May 20, 2010. Keep in mind the daily is very short term and for traders only. Investors should use weekly and monthly charts. In this case we are only using a daily bar chart with volume. Note the break to new highs in April that was false because the new high was not supported by an increase in volume. Note now the subsequent correction – an A-B-C followed by an extension for a total of five waves. Note how the volume has spiked. I am a buyer here for a bounce up to $40. I am stopped out on a close under $30

The squiggly line signals were mixed with the RSI trying to generate a bullish positive divergence signal, the plot was into support at the lower Bollinger Band and we seemed to be into support at the 200 day MA. The MACD was into over-sold territory and the Slow Stochastic was also trying t turn up and about to generate a bullish positive divergence buy signal.

Let us now look at a pure daily chart of Teck Resources at the close of May 20, 2010. Keep in mind the daily is very short term and for traders only. Investors should use weekly and monthly charts. In this case we are only using a daily bar chart with volume. Note the break to new highs in April that was false because the new high was not supported by an increase in volume. Note now the subsequent correction – an A-B-C followed by an extension for a total of five waves. Note how the volume has spiked. I am a buyer here for a bounce up to $40. I am stopped out on a close under $30

Tuesday, May 18, 2010

We Have Lost a Great One

I lost a very close personal friend to-day. Donald R. Stark passed away this morning and is survived by his wife Judy and their two daughters Amy and Jenny.

Don was also Canada’s greatest unknown technical analyst.

Don and I were rookie stock broker/advisors at Richardson Securities and we hooked up in the late 1960’s just a few years before the great 1973-1974 bear market. Don was that goofy guy who drew charts all day and basically ignored the research cranked out by Richardson’s Winnipeg head office. When the great 1973-1974 bear hit we all scattered with Don settling in with Draper Dobie Ltd where he met the soon-to-be cycle legend Ian S. Notley. When Dominion Securities acquired Draper Dobie in 1977 they also had the good fortune to acquire the genius of Stark and Notley who then set out to create the original RBC Capital Markets respected Trend & Cycle Department.

Don Stark was Ian Notley’s right hand. I still have a number of their brilliant 1980 through 1984 publications which I still review to-day. Their great top down calls ranging from calling the bond market “the buy of a generation” to predicting the re-structuring of the huge American multinationals and the early transition from the “old” economy to the “new” economy are the stuff from which legends are created.

In 1987 the Stark and Notley team left the then Dominion Securities Pitfield to part as friends with Ian moving to New England and Don joining myself and Karl Wagner at Market Fax info Services. Don spent another five years there crafting his quantitative and inter-market skills before moving on as a sub-advisor to several respected fund managers.

Don had a wild side ranging from flying jet fighters to driving fast cars to racing sail boats. Don was an expert seaman and he spent all of his latter years on his beloved sailboat plying the waters of Georgian Bay, Lake Ontario and the Caribbean. Thanks for the memories Don

Your pal Bill Carrigan

Don was also Canada’s greatest unknown technical analyst.

Don and I were rookie stock broker/advisors at Richardson Securities and we hooked up in the late 1960’s just a few years before the great 1973-1974 bear market. Don was that goofy guy who drew charts all day and basically ignored the research cranked out by Richardson’s Winnipeg head office. When the great 1973-1974 bear hit we all scattered with Don settling in with Draper Dobie Ltd where he met the soon-to-be cycle legend Ian S. Notley. When Dominion Securities acquired Draper Dobie in 1977 they also had the good fortune to acquire the genius of Stark and Notley who then set out to create the original RBC Capital Markets respected Trend & Cycle Department.

Don Stark was Ian Notley’s right hand. I still have a number of their brilliant 1980 through 1984 publications which I still review to-day. Their great top down calls ranging from calling the bond market “the buy of a generation” to predicting the re-structuring of the huge American multinationals and the early transition from the “old” economy to the “new” economy are the stuff from which legends are created.

In 1987 the Stark and Notley team left the then Dominion Securities Pitfield to part as friends with Ian moving to New England and Don joining myself and Karl Wagner at Market Fax info Services. Don spent another five years there crafting his quantitative and inter-market skills before moving on as a sub-advisor to several respected fund managers.

Don had a wild side ranging from flying jet fighters to driving fast cars to racing sail boats. Don was an expert seaman and he spent all of his latter years on his beloved sailboat plying the waters of Georgian Bay, Lake Ontario and the Caribbean. Thanks for the memories Don

Your pal Bill Carrigan

Sunday, May 16, 2010

Tea Leaves, Voodoo & Other Dark Forces

In the “old” days (before the Internet) the technical analyst was a true expert. Armed with only graph paper and a Texas Instrument programmable calculator they invented a new way to analyse stocks, indices and commodities. I have many of their classic publications such as the CRB Guide to Chart Analysis by John J. Murphy and New Concepts In Technical Trading Systems by J. Welles Wilder, JR.

Now thanks to the personal computer and the Internet everyone is a technical analyst with access to free on-line charts and over 200 technical studies to choose from. Our chart to-day is a tragic example of machines gone wild. This is a typical example of squiggly line madness so common to-day among industry pros who should know better. This study of Teck Resources is a candle stick daily chart accompanied by an RSI, Bollinger Bands, three moving averages, a MACD and a slow stochastic. That works out to at least 11 squiggly lines to ponder.

So here is the problem – aside from the fact that at least a million other “technicians” are looking at the same thing, these studies only work about one half the time. Look at how many buy and sell signals have been wrong. So now for a serous question, if you had serious money to manage – would you make an investment decision based on the voodoo analysis served up on this chart – or is there a better way? Over the next few weeks let me take us all back to the pure art of technical studies.

Now thanks to the personal computer and the Internet everyone is a technical analyst with access to free on-line charts and over 200 technical studies to choose from. Our chart to-day is a tragic example of machines gone wild. This is a typical example of squiggly line madness so common to-day among industry pros who should know better. This study of Teck Resources is a candle stick daily chart accompanied by an RSI, Bollinger Bands, three moving averages, a MACD and a slow stochastic. That works out to at least 11 squiggly lines to ponder.

So here is the problem – aside from the fact that at least a million other “technicians” are looking at the same thing, these studies only work about one half the time. Look at how many buy and sell signals have been wrong. So now for a serous question, if you had serious money to manage – would you make an investment decision based on the voodoo analysis served up on this chart – or is there a better way? Over the next few weeks let me take us all back to the pure art of technical studies.

Labels:

Buy,

Sell and Know When to Buy

Tuesday, May 11, 2010

Golden Opportunity (2)

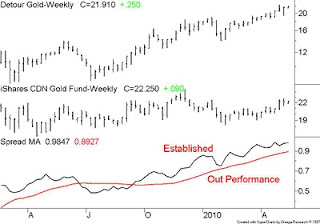

A few blogs ago I suggested that if the price of gold were to break above $1220 the gold producers will benefit from a bullish stampede into the group. If Gold stalls at 1220 we cut and run. Now aside from the Greece fiasco the technical attraction for the gold complex is the price of gold advancing in the face of a rising U.S. dollar. So now with price of gold just at or above the all-time peak set last December 2009 we can over-weight into the gold miners in anticipation of the group also running above the old December 2009 price peak. We do have options here - we could simply acquire the TSX listed iShares Gold ETF (XGD) or we could buy some gold stocks - or do a bit of both.

One reasonable option would be to buy the index - the iShares (XGD) and also buy one or two of the stronger names to enhance our returns. A quick relative performance scan solves the problem as we can see in our Detour Gold vs. iShares XGD chart. In this example Detour Gold is a long established sector out performer and so is a candidate to enhance our gold miner returns.

Some of the out perform names are Detour Gold (DGC), Eldorado Gold(ELD), Novagold Resources (NG), New Gold Inc. (NGD) and Red Back (RBI). Some of the under perform avoids are Gammon (GAM), Kinross (K), Vista (VGZ) and Yamana (YRI). The names not mentioned such as Barrick and GoldCorp are sector performers.

One reasonable option would be to buy the index - the iShares (XGD) and also buy one or two of the stronger names to enhance our returns. A quick relative performance scan solves the problem as we can see in our Detour Gold vs. iShares XGD chart. In this example Detour Gold is a long established sector out performer and so is a candidate to enhance our gold miner returns.

Some of the out perform names are Detour Gold (DGC), Eldorado Gold(ELD), Novagold Resources (NG), New Gold Inc. (NGD) and Red Back (RBI). Some of the under perform avoids are Gammon (GAM), Kinross (K), Vista (VGZ) and Yamana (YRI). The names not mentioned such as Barrick and GoldCorp are sector performers.

Labels:

Buy,

Sell and Know When to Buy

Tuesday, May 4, 2010

Options are for Dummies

A few days ago I got a "hunch to buy a bunch" of call options on Russel Metals (TSX-RUS) because I wanted some leverage on a possible upside advance from the current $20.60 back to over-head resistance at the $25 level

I figured the October $21 calls at $1.60 could be a good bet and so 10 contracts would cost $1600. My son who is an advisor at Union Securities reminded me that this would be a "sucker bet" because I had to get too many things right. I had to know when the stock was about to move, I had to know which way it would move and I had know to the magnitude of the move. I if was wrong on any one issue I would lose my entire investment

Darren told me to consider the company's convertible debentures. They are priced at about $109 with a coupon of 7.75% and a current yield at about 5.93%. The call on the stock is all the way out to Sept 2016 with a strike set at $25.75. In other words the bond is like a long term leap option that pays interest and won't go to zero if I am wrong. Looks almost like win-win, I get paid to wait if nothing happens and I get the upside if the stock pops. Leave those call options for the dummies and seek out those convertible debentures

I figured the October $21 calls at $1.60 could be a good bet and so 10 contracts would cost $1600. My son who is an advisor at Union Securities reminded me that this would be a "sucker bet" because I had to get too many things right. I had to know when the stock was about to move, I had to know which way it would move and I had know to the magnitude of the move. I if was wrong on any one issue I would lose my entire investment

Darren told me to consider the company's convertible debentures. They are priced at about $109 with a coupon of 7.75% and a current yield at about 5.93%. The call on the stock is all the way out to Sept 2016 with a strike set at $25.75. In other words the bond is like a long term leap option that pays interest and won't go to zero if I am wrong. Looks almost like win-win, I get paid to wait if nothing happens and I get the upside if the stock pops. Leave those call options for the dummies and seek out those convertible debentures

Labels:

Buy Sell and Know When to Buy

Golden Opportunity

I see that last Friday the following precious metals miners posted new 52-week highs – not bad when you consider the price of bullion and the S&P/TSX Gold Index are still trading below their respective price peaks of December 2009

New 52-week high list

Aurizon Mines Ltd. ARZ $5.79

Eldorado Gold Corp ELD $15.60

Novagold Resources. NG $8.99

New Gold Inc NGD $5.95

Red Back Mining Inc RBI $26.68

Silver Wheaton Corp SLW $19.96

Semafo, Inc. SMF $6.48

Silvercorp Metals SVM $8.33

Now I am just looking at the technical picture of gold and the gold miners and I am tuning out the noise of Greece, Spain, the threat of deflation, the Goldman Sachs fiasco and the potential of negative economic dislocations due to the Gulf oil spill.

Here is the play: Our Gold vs. Gold Stocks chart clearly displays the gold producers under performing the metal from 2009 to date. If the price of gold breaks above $1220 the gold producers will benefit from a bullish stampede into the group. If Gold stalls at 1220 we cut and run.

New 52-week high list

Aurizon Mines Ltd. ARZ $5.79

Eldorado Gold Corp ELD $15.60

Novagold Resources. NG $8.99

New Gold Inc NGD $5.95

Red Back Mining Inc RBI $26.68

Silver Wheaton Corp SLW $19.96

Semafo, Inc. SMF $6.48

Silvercorp Metals SVM $8.33

Now I am just looking at the technical picture of gold and the gold miners and I am tuning out the noise of Greece, Spain, the threat of deflation, the Goldman Sachs fiasco and the potential of negative economic dislocations due to the Gulf oil spill.

Here is the play: Our Gold vs. Gold Stocks chart clearly displays the gold producers under performing the metal from 2009 to date. If the price of gold breaks above $1220 the gold producers will benefit from a bullish stampede into the group. If Gold stalls at 1220 we cut and run.

Labels:

Buy,

Sell and Know When to Buy

Subscribe to:

Comments (Atom)