There are several ways for the technical analyst to measure the appetite for risk. The obvious way is to study risky assets such as the small cap indices and compare their relationship to the apparent less risky large cap indices. In a precious post I studied the Small Cap Index (XCS) vs. a Large Cap Index (XIU). We currently have a Risk Trade “ON” condition because the commodity sensitive XCS is beginning to out perform the XIU. We can also study the “Doomsday Trades” such as the 10-yr T-Note (TLT) or the Japanese YEN. Investors who embrace these “safe” assets are the perma-bears or lunatic fringe groups who basically couldn’t see a bull market in any asset class – even if it bit them on the ass.

Another sign of a return to risky assets would be a renewed round of takeovers and consolidation as corporations decide to put their cash to work. The recent $39 billion hostile bid for Potash Corp from BHP Billiton is a good example. I enjoyed some of the “Potash Effect” through the ownership of the Claymore Global Agriculture ETF (COW) and Viterra Inc. (VT). Now the task at hand is to seek out another takeover candidate or at least to latch on to an industry peer that should enjoy some of the “takeover effect”. Based on the recent takeover bids in the U.S. and Canada I scaned the commodity and technology sectors for stocks that display bid possibilities. The selection charted is displaying strong money flow numbers and a recent swing to relative outperform vs. the S&P/TSX60 large cap index (XIU) – any action here could ignite the entire copper producer space – Hudbay is a component of the TSX S&P/TSX Capped Diversified Metals & Mining Index.

Sunday, August 29, 2010

Tuesday, August 17, 2010

Measuring Risk Appetite (1)

There are several ways for the technical analyst to measure the appetite for risk. We need to do this because when investors become fearful they begin to avoid risky assets which could snowball into a nasty correction. In the early stage of risk aversion investors initially stop buying risky assets. As the risk aversion spreads investors adopt a sheep like tendency and begin to sell risky assets. The final stage is typically a bearish stampede away from anything deemed to be risky.

I often measure risk appetite by a study of the Small Cap Index (XCS) vs. a Large Cap Index (XIU). In Canada our small cap index is for the most part commodity sensitive and so if we have a Risk Trade “ON” condition you would get over-weight into the commodity space or at least own the TSX Materials Index.

Our small cap / large cap spread (see chart) clearly displays an aversion to risk in late 2008 as investors bailed out of the Small Cap index crating a Risk Trade ”OFF” condition. As the panic of late 2008 and early 2009 subsided the selling in the small caps abated. In mid 2009 investors returned to the small caps and set up a Risk Trade “ON” condition – In May 2010 some degree of risk aversion returned and in mid July 2010 we returned back to a Risk Trade “ON” condition. Next posting I will use a different methodology to measure risk aversion in the U.S. markets

I often measure risk appetite by a study of the Small Cap Index (XCS) vs. a Large Cap Index (XIU). In Canada our small cap index is for the most part commodity sensitive and so if we have a Risk Trade “ON” condition you would get over-weight into the commodity space or at least own the TSX Materials Index.

Our small cap / large cap spread (see chart) clearly displays an aversion to risk in late 2008 as investors bailed out of the Small Cap index crating a Risk Trade ”OFF” condition. As the panic of late 2008 and early 2009 subsided the selling in the small caps abated. In mid 2009 investors returned to the small caps and set up a Risk Trade “ON” condition – In May 2010 some degree of risk aversion returned and in mid July 2010 we returned back to a Risk Trade “ON” condition. Next posting I will use a different methodology to measure risk aversion in the U.S. markets

Labels:

Buy Sell and Know When to Buy

Tuesday, August 10, 2010

Natural Gas Seasonality Folklore

According to on-line book retailer John Wiley & Sons Inc (Public, NYSE:JW.A) the Commodity Trader's Almanac 2010 (Jeffrey A. Hirsch, John L. Person) is available in Canada for $47.95. They describe the publication to be “an indispensable resource for active traders from the Hirsch Organization and John Person. Provides the best in investment data and statistics, in the same calendar format as the trusted annual Stock Trader's Almanac (and) The Commodity Trader’s Almanac 2010 is your annual guide to commodities trading. Whether you’re a seasoned investor or just getting started in commodities this vital desk reference is packed with critical commodity trading seasonality trends, strategies and data for every active trader. I acquired my first copy in 1984 and manage to pick one up every five years or so because books on seasonality tend to be repetitious as they replicate the same information year after year.

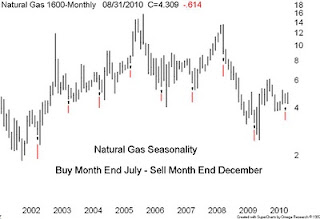

Currently natural gas prices are frustrating many investors as the recent down turn has once-again delayed a possible recovery – although technically we are still printing a bullish rolling series of higher lows. In desperation I looked into the seasonality aspect of the trade and according to the Almanac the best time to own gas is between August and December. Our chart is the monthly bar chart of natural gas spanning about 9-years. I have marked the July close with an “up” arrow with a red tail to identify the buy points. We are supposed to sell 5-bars later at the close of December. Note the advance from 2002 to 2005 – every time we sell high we end up buying in at even higher prices. The down of 2008 had us buying low and selling at even lower prices. I think I will stick to my bullish higher low scenario.

Currently natural gas prices are frustrating many investors as the recent down turn has once-again delayed a possible recovery – although technically we are still printing a bullish rolling series of higher lows. In desperation I looked into the seasonality aspect of the trade and according to the Almanac the best time to own gas is between August and December. Our chart is the monthly bar chart of natural gas spanning about 9-years. I have marked the July close with an “up” arrow with a red tail to identify the buy points. We are supposed to sell 5-bars later at the close of December. Note the advance from 2002 to 2005 – every time we sell high we end up buying in at even higher prices. The down of 2008 had us buying low and selling at even lower prices. I think I will stick to my bullish higher low scenario.

Labels:

Buy Sell and Know When to Buy

Monday, August 2, 2010

Investment Sheep

Last week I did a telephone interview with David Pescod’s Shop Talk (CANACCORD Wealth Management) and this is a clip

BC: There is nothing wrong with the market, the only thing wrong with the market right now is that people are afraid to take on risk and that could change on a dime. It could change at midday of any day. When it changes, it will change very quickly and catch most by surprise. It could change in the last hour of trading today, you know you just don’t know when that will happen but it will be a very sudden, quick, take everybody by surprise. So I wouldn’t wait until the fall, I would be ready for it right now. All we need is

a change in sentiment; there is nothing technically wrong with the markets.

DP: One thing we notice as brokers of course is the amazing quiet out there. Volumes are just nonexistent it seems.

BC: Everybody is asleep.

DP: Is it that they are asleep or that they are afraid?

BC: They’re afraid. They are sort of in a fearful, almost comatose state. Fear of doing anything, and that will change very quickly. It’s like a bunch of sheep cowering in a corner waiting for a storm that doesn’t happen, and all of a sudden when the clouds part the sheep are right back in the meadow again and very quickly they will just move all together.

Our chart is the inter-day NYSE action on transportation bellwether Canadian Pacific up almost 2% - we are above a rising 40 wk MA, the relative is strong and we are flirting with a new 52-week high. I have no idea why the investment sheep are on the sidelines.

BC: There is nothing wrong with the market, the only thing wrong with the market right now is that people are afraid to take on risk and that could change on a dime. It could change at midday of any day. When it changes, it will change very quickly and catch most by surprise. It could change in the last hour of trading today, you know you just don’t know when that will happen but it will be a very sudden, quick, take everybody by surprise. So I wouldn’t wait until the fall, I would be ready for it right now. All we need is

a change in sentiment; there is nothing technically wrong with the markets.

DP: One thing we notice as brokers of course is the amazing quiet out there. Volumes are just nonexistent it seems.

BC: Everybody is asleep.

DP: Is it that they are asleep or that they are afraid?

BC: They’re afraid. They are sort of in a fearful, almost comatose state. Fear of doing anything, and that will change very quickly. It’s like a bunch of sheep cowering in a corner waiting for a storm that doesn’t happen, and all of a sudden when the clouds part the sheep are right back in the meadow again and very quickly they will just move all together.

Our chart is the inter-day NYSE action on transportation bellwether Canadian Pacific up almost 2% - we are above a rising 40 wk MA, the relative is strong and we are flirting with a new 52-week high. I have no idea why the investment sheep are on the sidelines.

Labels:

Buy,

Sell and Know When to Buy

Subscribe to:

Comments (Atom)