A

clip from Getting Technical letter - Interim Update October 7, 2013 GT1413 a

refresher on using natural stock sector rotation: The various stock sectors

advance and decline in reaction to the expansion and contraction of the

business cycle. Typically the “front end” of the market – the Financial,

Telecommunications Services and Utilities begin to rise in anticipation of

improving business conditions and a low interest rate environment. This

stimulates the “middle” of the market and the Technology and Industrial stock

sectors begin to rise in anticipation of improved corporate spending. The

growing demand for goods stimulates the need for raw materials and the “back

end” of the market – Materials, Mining and Energy, begin to advance

As

the economy expands, inflation fears trigger higher interest rates and the

“front end” of the market peaks in anticipation of a slowdown in consumer

spending. As the slowdown becomes evident the “middle” sectors peak as

industrial demand slows eventually dragging down the lagging commodity

sensitive “back end” stock sectors.

Sector #

Financials Leading -

Interest rate sensitive

Telecommunications

Service Leading - Economy sensitive

Utilities Leading -

Interest rate sensitive

Consumer

Discretionary Coincident - Economy

sensitive

Consumer

Staples Coincident -

Defensive

Health

Care Coincident

- Defensive

Information

Technology Coincident - Economy

sensitive

Industrials Coincident -

Economy sensitive

Energy Lagging -

Commodity sensitive

Materials Lagging -

Commodity sensitive

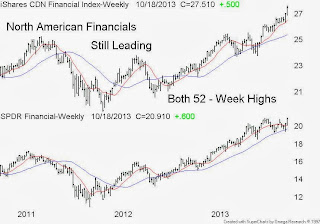

So

here is the problem for the bears – The North American Financials are still

leading having posted as a group - new 52 week highs at the close on Friday

October 18, 2013. By the way – the last time the SPDR XLF peaked was in May 2007,

5 months ahead of the S&P500 peak of October 2007.

No comments:

Post a Comment