I

presented at the Toronto World MoneyShow on October 18, 2014 and explained how

I used technical analysis to select at least 5 takeover candidates during my

time as a sub-advisor to the Union Securities Hybrid program. For a copy just

post a blog comment or contact me at info@gettingtechnical.com

I

took questions on the fly and several centered on my views of the recent global

sell-off in the equity markets – I was prepared and proceeded to display

several crisis-related graphic – front page - headlines displayed by the

financial press.

The

first was a cartoon of and upside down bull (Barron’ s October 19, 1987. The

second was a list of “Canada’s

hottest dot-coms” (Globe Report on Business June 22, 2000. The third was a

cartoon of several great US

financial giants being swallowed by a giant black hole, “A Day Of Reckoning” (Globe

Report on Business September 16, 2008). The fourth was a full page one-day dive

of the Dow Industrials, “Worst one-day fall etc.” (Globe Report on Business

August 5, 2011 and finally a full page graph of the TSX Comp and the TSX Energy

sector crashing, “FORTY-DAY FREEFALL”, (Globe Report on Business October 15,

2014). In each example these huge banners were published very near to important

troughs or peaks, - a great contrarian indicator.

At

least the Globe is creative, a Toronto Star item - Monday, October 20, 2014 just

rehashed an old correction classic “Why this market correction is no cause for

panic:” The author advises the readers to, “turn off the TV. Ignore the noise” and

that “the best companies pay dividends“- advice from an author

with no financial accreditation.

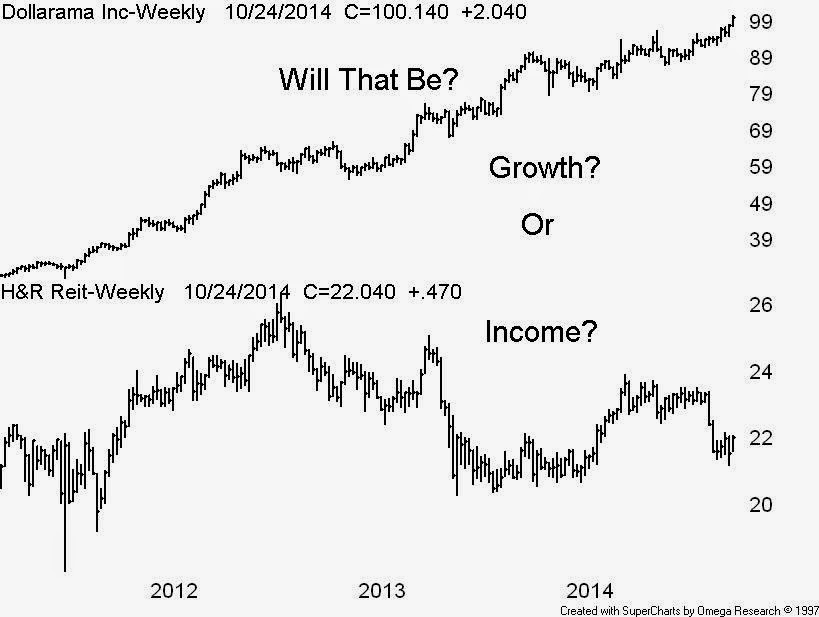

Well,

some of the “best companies” had big declines from their recent 2014 price

peaks, Bank of Nova Scotia -15%, BCE Inc -10%, CDN Natural Resource -29%, CNR -16%,

Enbridge -18% and TransCanada – 22% - I could go on. The chart today displays a

low yield growth company plotted above a big dividend payer – and how about those

dividend paying Dow components - Coca-Cola Co. (KO), McDonald’s Corp (MCD) and

the late great IBM – all big dividend payers and share buy-back losers

No comments:

Post a Comment