Dumb or annoying companies and stupid CEO commentary

There are three types of companies - value, growth and socially responsible. Now a value company can also be socially responsible, and a growth company can also be socially responsible. Occasionally you will find a company that is just plain dumb – all hype and an endless stream of bull dust press releases.

I also tend to run away from annoying companies who blow away their cash on share buybacks in order to create the illusion of earnings growth. The easiest way to spot both a dumb and annoying company is to identify a stupid CEO – who when questioned by the business media will say “my first responsibility is to the shareholders.”

Hello? Your first responsibility is to society and then your customers – do that and the shareholder "problem" will resolve itself.

Now I know that socially responsible can include no tobacco, no alcohol, no forest clear cutting, no open pit mining, no child labour, no guns and no toxic pond tailings. Socially responsible companies are also sensitive to the issues of Free Trade and Fair Trade.

If you are not clear on the difference between free and fair trade follow this link

http://www.thestar.com/business/article/681602 to a stunning item in the Toronto Star - Saturday August 15, 2009 - an item called Banana Republic - a must read

Did you know that Bananas are the most popular fruit in Canada and around the world? with the average person eating 14 kilograms per year. Some 275,000 Ecuadorians work in the trade and one in every four bananas consumed in North America comes from this corner of Latin America

Despite the size of the industry, only a fraction of bananas exported around the world are considered fair trade, a certification that guarantees a degree of equity and equality for farmers. In a few countries, fair trade bananas have a big share of the market a quarter in the United Kingdom, for example. But in Canada, barely 1 per cent of bananas are fair trade.

Free trade workers work for the biggest fruit companies, receiving no benefits, no pension, no medical care, no guaranteed wage and no holidays. They are routinely sprayed with pesticides deemed illegal in North America for more than a generation.

Free trade banana workers have blamed cancers, respiratory diseases, birth defects and sterility on routine exposure to pesticides. Some, like the 16,000 workers from Costa Rica, Ecuador, El Salvador, Guatemala, Honduras, Nicaragua and the Philippines who took several fruit and chemical companies (including Dole, Chiquita and Del Monte) to court, have received settlements to compensate for their injuries.

Only 1 per cent of farmers in this region work on a fair trade organic banana plantation. One worker is quoted "They don't spray me any more," he says. "I get medical help if I'm injured at work. I even get a basket with a chicken in it at Christmas time."

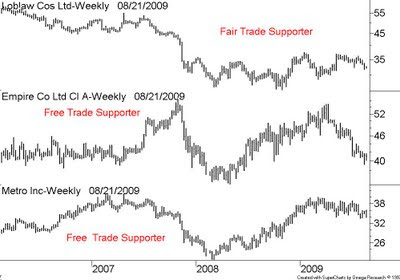

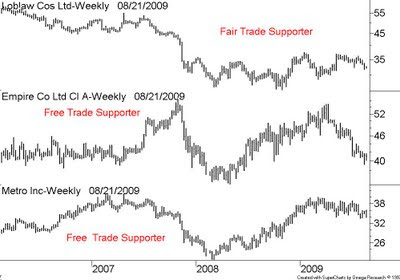

Where can you get fair trade bananas in Canada? Apparently at Loblaws food stores. Loblaw Companies Limited (TSX-L) is a Canada-based company. The Company is engaged in food distribution and is also a provider of drugstore, general merchandise and financial products and services. The Company is a subsidiary of Weston Limited (Weston). The Company offers the Canada’s (private) label program, including President’s Choice, no name and Joe Fresh Style brands

Where can you NOT get fair trade bananas? Apparently not at Metro, Inc. (TSX-MUR.A) is a Canada-based food retailer and distributor. The Company operates a network of supermarkets, discount stores and drugstores in Quebec and Ontario. As of September 27, 2008, Metro, Inc. operated 558 food stores and 268 drugstores. It operates 380 supermarkets under the banners Metro, Metro Plus, A&P, Dominion and Loeb

Don’t look for fair trade bananas at the Empire Company Limited (TSE-EMP.A) which is engaged in food retailing, real estate, and investments and other operations. Food retailing is carried out through wholly owned Sobeys Inc. (Sobeys).

It seems to me the best way to punish socially irresponsible companies is to turn rich investors into poor investors by refusing to invest in the shares of these companies

Fair Trade Supporter Loblaw needs our vote