The next big thing is a key “must know” for long term investors who wish to make above average market returns without excessive trading in and out of volatile stocks. The next big thing is a pending dominant theme that can persist for at least 10 years. The dominant theme will drive the beneficiaries upward to all time highs and for the most part will have long bull cycles interrupted by short flat bear cycles.

Some past dominant themes were the Nifty Fifty of the 1950’s and 1960’s. The mid to late 1970’s introduced the modern economy or first technology boom of the English speaking countries. The mid 1980’s introduced a parallel boom in the financial services sector – so for twenty years from 1980 to 2000 all you had to do was to own technology and bank stocks. Some past false booms were infrastructure and alternate energy.

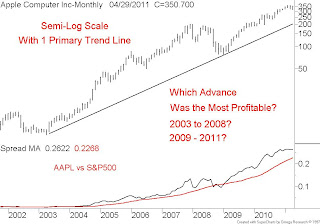

Our chart is about 15-years of the technology weighted Nasdaq Composite that clearly displays the first technology bubble that was confined within the English speaking countries. The 2000 – 2010 period is a 3-cycle secular bear which is now almost completed. Yesterday the Nasdaq jumped to a 10-year high as U.S.