Technically

there are several problems with the tape with one issue being the failure of

the NYSE advance / decline line to hold above the breakout of early December

and the other being the current bearish setup of a pending Dow Theory “sell”

signal.

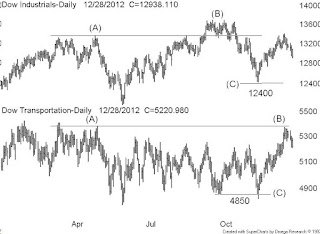

There

is a lot of components to Dow Theory but I will just focus on the averages must

confirm part. Take a look at our Dow Industrials over the Dow Transports chart

where I have marked the mid 2012 peaks at (A). Now note the subsequent rally to

new highs by the Industrials to (B) and the failure of the Transports to

confirm at the lower plot (B). That alone is not a Dow “sell” signal because while

it sets up a negative divergence condition we still need the two averages to

confirm the “sell” by subsequently dropping below the lows at (C) which is

12400 on the Industrials and 4850 on the Transports. If we get the “sell” adopt

a low risk strategy through 2013.