Is this the beginning of a new bull market or – just another bear market rally?

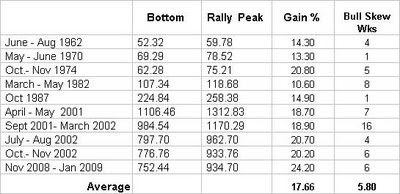

The bears sitting on the sidelines are praying for a correction – even a retest of the March lows so they can finally get invested. One money manager sitting in cash has gone public with the following table setting out modern bear market rallies in the S&P500 since 1960

The average gain was 17.66% and the average bull skew in weeks was 5.8 weeks – compare those numbers to the current advance - now gaining 30+% and into week 12 which in terms of magnitude and time are both double the average modern bear rally – We conclude the current advance is not a bear rally – and that’s no bull

The April – May 2001 bear market rally