This is a follow up on a piece I authored entitled - Life is a gamble, so don't be a mercantile mollusc. Below is the original text which appeared in the Toronto Star on Sat Nov 21, 2009.

----------------------------------------

Life is a gamble, so don't be a mercantile mollusc.

Last week, an investment reporter asked four prominent market strategists for their take on the market's valuation. David Rosenberg of Gluskin Sheff and Associates said: "No matter which way you look at it – forward P/E, trailing P/E – the market is vastly overpriced, (and) so the strategy is to sit on the sidelines, be selective in our equity choices, and wait for the correction to come or for the fundamentals to catch up with this overvalued, overbought, overextended market." Another said: "People who are raising the red flag about markets being overvalued are those who missed the rally."

While entertaining, the confrontation is simply a minor bull and bear scrum stimulated by a financial writer asking an irrelevant question. The market is never priced on what stocks are worth today, but rather what stocks will be worth several quarters from now. The markets are forward looking and that is why the "valuations" never catch up to rising prices in a bull market.

These are harmless bull and bear arguments that are, for the most part, just noise and quickly forgotten.

The real danger to the average investors are the professional fear mongers, who use fear to influence the opinions and actions of others towards some specific end. The feared object or subject is sometimes exaggerated, and the pattern of fear mongering is usually one of repetition, in order to continuously reinforce the intended effects of this tactic. Inciting fear is also a technique to gain notoriety and influence. Some financial advisers and money managers use fear mongering as a means to attract investors to the safety of their enterprise and away from their current and supposedly dangerous adviser.

I recall a "Night with the Bears" held on April 7, a speaker's series organized by Sprott Asset Management. Guests include Eric Sprott, Meredith Whitney of Meredith Whitney Advisory Group, Nouriel Roubini of New York University and Ian Gordon, author of The Longwave Analyst newsletters.

A packed house gasped as "lunatic fringe" cycle expert Ian Gordon predicted the Dow Industrials would hit 1,000 before this downturn is over. Gordon's analysis is based on the Kondratiev long wave or K-wave which spans about 50-plus years as measured from trough to trough.

Fear mongering can sway many investors into avoiding any type of risk. Sit on cash and don't invest. Don't buy a house. Don't change jobs. Don't borrow. Don't start a business and don't trust anyone.

The following is a quote from the classic publication, Reminiscences of a Stock Operator by Edwin LeFevre: "Among the hazards of speculation the happening of the unexpected, I might even say of the unexpectable, ranks high. There are certain chances that the most prudent man is justified in taking – chances that he must take if he wishes to be more than a mercantile mollusc.

"Normal business hazards are no worse than the risks a man runs when he goes out of his house into the street or sets out on a railway journey (and) life itself from the cradle to the grave is a gamble and what happens to me because I do not possess the gift of second sight I can bear undisturbed."

I recall a recent conversation with a good friend whose daughter had just bought a small house in a Hamilton suburb. "She's crazy," he said. "Paying that much and going into debt like that." I responded; "Calm down, I have owned several homes over the past 40 years and I paid too much for every one of them. My first East York bungalow cost me $18,000."

Most of the financially independent people I have met acquired their wealth either by inheritance, real estate, stocks or a family business. Although most of us will never inherit a fortune or own a successful business we should at least take on some risk in the form of home and/or common stock ownership.

Our chart this week is 25 years of monthly closes of our own TSX Composite stock index plotted above the average Greater Toronto resale home price. The longer term trend for both asset classes is upward with the TSX returning about 10 per cent annualized and the single family home returning about 5 per cent annualized.

The higher return of stocks is accompanied by higher volatility and lower return of the home is accompanied by tax-free gains and shelter. All and all, both are worth the risk, so don't be a mercantile mollusc.

----------------------------------------

On Tuesday, December 22, 2009 Jason K. Rogers, Business Development Manager Longwave Group emailed me the following comments

Dear Mr. Carrigan,

I am writing with respect to your recent article, wherein you made reference to 'A night with the Bears', hosted by Sprott Asset Management on April 7, 2009. I was interested to read that "A packed house gasped as lunatic cycle expert Ian Gordon predicted that the Dow (Jones) industrials would hit 1,000 before this downturn is over." How would you know what the reaction of the crowd was since you declined to attend? On April 11, 2009, you wrote, "Last Monday I got an invitation from a public relations firm to spend 'A Night with the Bears' at the Elgin

Theatre... I declined because these bears have been wearing the bearish views on their sleeves for the past several years and, quite frankly, I would rather have a root canal than sit through that again."

What precisely do you mean by 'sit through that again?' When did you last sit through a round table discussion which presented the bearish point of view? Your bias is showing! Wouldn't it assist you to keep an open mind by listening to another point of view? Your perpetual bullishness appears to be based upon nothing more than the fact that you hate bears?

As for Mr. Gordon's lunatic cycle interpretation, clearly you haven't visited his website www.longwavegroup.com. If you did, you would realize that Mr. Gordon has been consistently correct in predicting the financial and economic events that are now occurring. This is not "fear

mongering," rather, it is called being realistic. Mr. Gordon has clearly demonstrated that history does repeat itself. He has convincingly, reasoned that we are now repeating the deflationary depression of the 1930s, and that's not bullish.

Acting upon his long wave economic cycle interpretations, Mr. Gordon has increased the value of his RRSP more than twenty-fivefold since May, 2002. There is an old saying within the investment industry: "There are times when bulls make money, bears make money, but pigs make

nothing!"

Kind regards,

Jason K. Rogers

Business Development Manager

Longwave Group

-----------------------------------------

Bill Carrigan's response to Jason K. Rogers – point by point and then a general observation

Hello Mr. Rogers - In response to your questions and opinion:

Q: How would you know what the reaction of the crowd was since you declined to attend?

A: Although I declined to attend, a Globe & Mail business writer did so and commented on the crowd reaction and also suggested that attendees upon leaving should have been provided with razor blades.

Q: What precisely do you mean by 'sit through that again?' When did you last sit through a round table discussion which presented the bearish point of view?

A: The business media is loaded with fear mongering "experts" seeking attention to further their personal business enterprise. I and others have heard it all. I guess you forgot about the BNN interview before the "night with the Bears"

Q: Your perpetual bullishness appears to be based upon nothing more than the fact that you hate bears?

A: I am not a perpetual bull - I wrote and spoke publicly about the breakdown in the financial stocks early in 2008. I don't hate bears but I have little regard for "off-the-wall" calls that are an embarrassment to legitimate non-conflicted analysis. A call for Dow 1000 is a desperate attempt to grab some attention in the business media. At Dow 10,000 we need one half of the components to go to zero and the other half to lose 50% just to get to Dow 2500.

Q: As for Mr. Gordon's lunatic cycle interpretation, clearly you haven't visited his website www.longwavegroup.com. If you did, you would realize that Mr. Gordon has been consistently correct in predicting the financial and economic events that are now occurring

A: Yes I did visit the web site and yes I am well aware of the fourth Kondratieff winter and have read Gordon's bearish item - The Long Wave Analyst - January 2003, Volume 5 Issue 1, 20 pages commenting on The Kondratieff Winter and the looming Depression. I quote Jonathan Chevreau - Financial Post Tuesday, June 10, 2003 item, "Gordon believes we are currently recapitulating the 1930s bear market and are in the beginning stages of a deflationary depression, similar to the thesis Robert Prechter Jr. takes in his bestselling book, Conquer the Crash." Can I reasonably conclude that Mr. Gordon missed the great 2003 - 2007 global bull market in equities and I also gather he has missed the great 2009 global bull market in equities?

Q: Acting upon his long wave economic cycle interpretations, Mr. Gordon has increased the value of his RRSP more than twenty-fivefold since May, 2002.

A: 25 fold? Are you really claiming Gordon and his clients each turned $10,000 into $250,000 since May, 2002?

-----------------------------------------

And now the reality of the Kondratieff Long Wave (K-Wave):

The trough to trough span of the K-Wave is about 52 years and so we as humans will only experience two troughs or two peaks in one life-time. The idea of planning our lives to "fit" the K-Wave is silly. Can you imagine a young family in the Kondratieff Spring of the 1960's committing to home ownership, children, common stock investing, that summer cottage, travel and consumer spending just because of a Kondratieff Spring? Can you now imagine the same family baling out of their home, their stock portfolio to buy gold in the 1980's because it is a Kondratieff Autumn?

One minor detail - there is no correlation between equity prices and the K-Wave. The two best time to buy equities was in 1942 (Pearl Harbor and a K-Wave Spring) and again in 1982 during a K-Wave Autumn. There is also no correlation between wars and the K-Wave. The U.S. Civil War occurred during a K-Wave Spring and WWII occurred during a K-Wave Winter.

I also have a problem with Gordon's K-Wave trough target of year 2020. With a 52-year cycle and the last trough at 1950 I get an idealised trough at year 2002. I gather the next K-Wave Winter is scheduled to begin in year 2050 and if I'm still above the grass I'll be too old to give a damn

One final note, I recall the Y2K fiasco when on January 1, 2000 all of the doom and gloomers vanished. What will become of the Longwave Group when we enter a K-Wave Spring?

Bill Carrigan

Tuesday, December 29, 2009

Thursday, December 10, 2009

The December Free Lunch

December more than any other month is loaded with seasonality folklore which is recycled annually in the business dailies.

The seasonality bible is the Stock Trader’s Almanac first published in 1967. This book allowed Mr. Hirsch to distil his lifelong interest in stock market history, cycles and patterns into a practical working tool for the average investor. It was the first compilation of the market’s seasonal trends and tendencies combined with a calendar and laid out for use by non-institutional investors.

One of the mid December seasonal plays is the “free lunch” wherein investors tend to get rid of their losing stocks near year-end for tax purposes. This often has the effect of driving the prices down to near 52-week lows. The Stock Trader's Almanac has shown that NYSE stocks selling at their lows on December 15 will usually outperform the markets through the following late January and early February. I assume the TSX would follow the same model.

I ran a stock filter on the listed TSX stocks seeking out issuers that were trading too far below their 100 day moving averages on a historical basis. About 80 names popped up as candidates for attracting tax-loss sales over the next few weeks. If our “free lunch” theory works these names should deliver nice above market rebounds through January and into mid February of 2010.

Our chart below sets out two likely suspects for a January – February rebound

The seasonality bible is the Stock Trader’s Almanac first published in 1967. This book allowed Mr. Hirsch to distil his lifelong interest in stock market history, cycles and patterns into a practical working tool for the average investor. It was the first compilation of the market’s seasonal trends and tendencies combined with a calendar and laid out for use by non-institutional investors.

One of the mid December seasonal plays is the “free lunch” wherein investors tend to get rid of their losing stocks near year-end for tax purposes. This often has the effect of driving the prices down to near 52-week lows. The Stock Trader's Almanac has shown that NYSE stocks selling at their lows on December 15 will usually outperform the markets through the following late January and early February. I assume the TSX would follow the same model.

I ran a stock filter on the listed TSX stocks seeking out issuers that were trading too far below their 100 day moving averages on a historical basis. About 80 names popped up as candidates for attracting tax-loss sales over the next few weeks. If our “free lunch” theory works these names should deliver nice above market rebounds through January and into mid February of 2010.

Our chart below sets out two likely suspects for a January – February rebound

Saturday, November 28, 2009

The Commodity Party – Time to Leave

Experience has taught me one thing for certain about investing – that is when something is certain, it us usually not certain. What I mean is, when we all know for sure – the “for sure” thing is not for sure. Right now we all know the U.S. dollar is going to zero and commodities are going to the moon – so keep selling the dollar and keep buying those commodities.

Experience has taught me to avoid over-crowed trades – to always be on the lookout for sheep-like investment behaviour. Right now too many sheep-like analysts love Baah Baah Rick Gold (TSX-ABX) and so I bailed last week at $47.

Our very long term chart below illustrates the cyclic path of the current secular advance in two of the important commodities – gold and crude. A secular trend (up or down) is a long term advance – usually 12 years – that is interrupted by shorter bull and bear cycles. The structure of the secular advance can be seen when broken into 5 cycles

Cycle (1) is the recognition of survival cycle wherein the market anticipates the survival of many smaller O&G producers and mining companies. The fundamentals are still weak. Cycle (2) is the big “money” cycle wherein anything you own in the sector goes up. Cycle (3) is the disappointing cycle when investors discover some headwinds such as squeezed profit margins and environmental concerns. Cycle (4) is the sheep cycle, the speculative bubble. The fundamentals are strong but divergences appear as not all components enjoy the bullish stampede. Cycle (5) can be a bull trap or a bear market rally that may or may not make new highs. Clearly the lower fruit has been picked – leave the higher stuff for the sheep.

Experience has taught me to avoid over-crowed trades – to always be on the lookout for sheep-like investment behaviour. Right now too many sheep-like analysts love Baah Baah Rick Gold (TSX-ABX) and so I bailed last week at $47.

Our very long term chart below illustrates the cyclic path of the current secular advance in two of the important commodities – gold and crude. A secular trend (up or down) is a long term advance – usually 12 years – that is interrupted by shorter bull and bear cycles. The structure of the secular advance can be seen when broken into 5 cycles

Cycle (1) is the recognition of survival cycle wherein the market anticipates the survival of many smaller O&G producers and mining companies. The fundamentals are still weak. Cycle (2) is the big “money” cycle wherein anything you own in the sector goes up. Cycle (3) is the disappointing cycle when investors discover some headwinds such as squeezed profit margins and environmental concerns. Cycle (4) is the sheep cycle, the speculative bubble. The fundamentals are strong but divergences appear as not all components enjoy the bullish stampede. Cycle (5) can be a bull trap or a bear market rally that may or may not make new highs. Clearly the lower fruit has been picked – leave the higher stuff for the sheep.

Tuesday, November 24, 2009

Why Business Writers Love December

December more than any other month is loaded with seasonality folklore which is recycled annually in the business dailies.

It all begins with the U.S. Thanksgiving trade wherein you buy at the beginning of the week and then sell into strength on the Friday. We then move on to the December “free lunch” and then the Santa Claus Rally which is followed by the January Effect and finally the January Barometer.

The seasonality bible is the Stock Trader’s Almanac. Jeffrey Hirsch is editor-in-chief of the Stock Trader's Almanac and Almanac Investor newsletter. He started with the Hirsch Organization in 1990 as a market analyst and historian under the mentorship of his father Yale Hirsch the founder of the Stock Trader’s Almanac. Drawing on years of market study, Yale created the unique Stock Trader’s Almanac, in 1966. It was first published in 1967. This book allowed Mr. Hirsch to distil his lifelong interest in stock market history, cycles and patterns into a practical working tool for the average investor. It was the first compilation of the market’s seasonal trends and tendencies combined with a calendar and laid out for use by non-institutional investors. It also brought to the general public many “statistically predictable” market phenomena that have since become well known, such as the impact of the four-year Presidential Election Cycle, plus discoveries such as the “January Barometer” and the “Santa Claus Rally.”

Unfortunately only a few seasonal trends are supported by technical analysis – the most important of which is the January Effect – a period beginning mid December through the following January where the smaller companies may outperform the larger companies. A weak January Effect is a bad omen and could be a negative for the next twelve months.

A must read - The Stock Traders Almanac – visit: www.stocktradersalmanac.com

It all begins with the U.S. Thanksgiving trade wherein you buy at the beginning of the week and then sell into strength on the Friday. We then move on to the December “free lunch” and then the Santa Claus Rally which is followed by the January Effect and finally the January Barometer.

The seasonality bible is the Stock Trader’s Almanac. Jeffrey Hirsch is editor-in-chief of the Stock Trader's Almanac and Almanac Investor newsletter. He started with the Hirsch Organization in 1990 as a market analyst and historian under the mentorship of his father Yale Hirsch the founder of the Stock Trader’s Almanac. Drawing on years of market study, Yale created the unique Stock Trader’s Almanac, in 1966. It was first published in 1967. This book allowed Mr. Hirsch to distil his lifelong interest in stock market history, cycles and patterns into a practical working tool for the average investor. It was the first compilation of the market’s seasonal trends and tendencies combined with a calendar and laid out for use by non-institutional investors. It also brought to the general public many “statistically predictable” market phenomena that have since become well known, such as the impact of the four-year Presidential Election Cycle, plus discoveries such as the “January Barometer” and the “Santa Claus Rally.”

Unfortunately only a few seasonal trends are supported by technical analysis – the most important of which is the January Effect – a period beginning mid December through the following January where the smaller companies may outperform the larger companies. A weak January Effect is a bad omen and could be a negative for the next twelve months.

A must read - The Stock Traders Almanac – visit: www.stocktradersalmanac.com

Thursday, November 19, 2009

Managed Exchange Traded Funds?

Whatever happened to the actively managed mutual fund vs. the passive index or sector exchange traded fund (ETF) battle?

Several years ago investors began to flee active mutual fund managers because for the most part, they failed to match the performance of their benchmark index or stock sector. The investment industry responded with cheaper passive ETFs that tracked the performance of the major stock indices (index funds) and sectors such as Financials, Energy, Materials and so on. Now the manufactures of ETFs have a problem – there are just too many – too much competition and so they have invented a new product – the actively managed ETF. So now we go full circle – from actively managed mutual funds to passive ETFs and now back to actively managed ETFs.

One of the original active ETF entries was PowerShares FTSE RAFI US 1000 Portfolio (NYSE:PRF) which seeks investment results that correspond generally to the price and yield of an equity index called the FTSE Research Affiliates Fundamentals US 1000 Index. The Index is designed to track the performance of the largest United States equities, selected based on four fundamental measures of firm size: book value, cash flow, sales and dividends. The 1000 equities with the highest fundamental strength are weighted by their fundamental scores

Here is the shocker – on November 18, 2009 -- Research Affiliates LLC announced that the United States Patent and Trademark Office has approved the issuance of U.S. Patent No. 7620577 for the company's innovative Research Affiliates Fundamental Index® ("RAFI®") indexing methodology, which selects and weights securities using fundamental metrics of company size rather than by market capitalization.

In other words a large cap value fund has a patented managed methodology – all very stimulating because if the methodology is patented - it must be good. Right? Well, let me now compare the “patented” managed fund to another large cap value fund, its called the Dow Jones Industrial Average, a basket of America’s biggest value companies – most of them multinationals. The best way to compare the difference is to use a simple spread or ratio chart. The inception of the fund is December 2005 and the Dow (now over 100 years old) recently had two components vaporized in the 2008 financial crisis. Our simple spread clearly the passive Dow out performed the managed ETF through 2006, 2007 and 2008 with the ETF posting an out perform only from March 2009 to October 2009.

The other problem with the managed ETFs is their poor liquidity and low volume. For example at the close of November 19 the PRF was bid 46.67 and ask 47.80 with total volume 28,240 The competing Diamonds Trust (NYSE:DIA) was bid 103.63 and ask 103.77 with total volume 12,739,200

Now if anyone out there knows of a managed ETF that works I am all ears

Several years ago investors began to flee active mutual fund managers because for the most part, they failed to match the performance of their benchmark index or stock sector. The investment industry responded with cheaper passive ETFs that tracked the performance of the major stock indices (index funds) and sectors such as Financials, Energy, Materials and so on. Now the manufactures of ETFs have a problem – there are just too many – too much competition and so they have invented a new product – the actively managed ETF. So now we go full circle – from actively managed mutual funds to passive ETFs and now back to actively managed ETFs.

One of the original active ETF entries was PowerShares FTSE RAFI US 1000 Portfolio (NYSE:PRF) which seeks investment results that correspond generally to the price and yield of an equity index called the FTSE Research Affiliates Fundamentals US 1000 Index. The Index is designed to track the performance of the largest United States equities, selected based on four fundamental measures of firm size: book value, cash flow, sales and dividends. The 1000 equities with the highest fundamental strength are weighted by their fundamental scores

Here is the shocker – on November 18, 2009 -- Research Affiliates LLC announced that the United States Patent and Trademark Office has approved the issuance of U.S. Patent No. 7620577 for the company's innovative Research Affiliates Fundamental Index® ("RAFI®") indexing methodology, which selects and weights securities using fundamental metrics of company size rather than by market capitalization.

In other words a large cap value fund has a patented managed methodology – all very stimulating because if the methodology is patented - it must be good. Right? Well, let me now compare the “patented” managed fund to another large cap value fund, its called the Dow Jones Industrial Average, a basket of America’s biggest value companies – most of them multinationals. The best way to compare the difference is to use a simple spread or ratio chart. The inception of the fund is December 2005 and the Dow (now over 100 years old) recently had two components vaporized in the 2008 financial crisis. Our simple spread clearly the passive Dow out performed the managed ETF through 2006, 2007 and 2008 with the ETF posting an out perform only from March 2009 to October 2009.

The other problem with the managed ETFs is their poor liquidity and low volume. For example at the close of November 19 the PRF was bid 46.67 and ask 47.80 with total volume 28,240 The competing Diamonds Trust (NYSE:DIA) was bid 103.63 and ask 103.77 with total volume 12,739,200

Now if anyone out there knows of a managed ETF that works I am all ears

Sunday, November 15, 2009

Research In Slower Motion

One of the rules of successful investing is to not get distracted by the noise served up on a daily basis by the business media. When we focus on stuff like auto sales, housing starts, consumer spending, Chinese growth and forecasts by TV personalities like Dr. Doom and the Raging Bull we overlook what the markets are telling us

Did anyone out there notice the new 52-week high posted last Friday by the Technology Select Sector SPDR Fund (NYSE-XLK). Yes – the tech stocks are attracting money – we seem to have another technology boom - probably driven by the global economy.

The Canadian peer - the TSX listed Information Technology Index (XIT) is lagging because if the heavy-weight component Research In Motion problems. There is growing concern about increasing Smartphone competition and the potential for longer-term declining ASPs (average selling prices) and profit margins.

The reality is RIM, the corporation is going through transition from a youthful risky enterprise into a middle age cash cow - basically a fourth Elliott Wave – a long period of transition - unless RIM an do an Apple and re-invent itself. By the way, Elliott fourth wave periods are confirmed when the original innovators are distracted by self-serving irrelevant hobbies such as collecting art, professional sport franchises and kite surfing.

Wednesday, November 11, 2009

Fear mongering

Do you grow weary of the persistent use of fear mongering as a tool by the financial media to attract an audience?

According to http://en.wikipedia.org/wiki/Fear_mongering - fear mongering (or scaremongering) is the use of fear to influence the opinions and actions of others towards some specific end. The feared object or subject is sometimes exaggerated, and the pattern of fear mongering is usually one of repetition, in order to continuously reinforce the intended effects of this tactic.

Inciting fear is a technique to gain notoriety and influence. Some financial advisors and money managers use fear mongering as a means to prospect for new clients - to attract investors to the safely of their enterprise and away from their current and dangerous advisor.

I recall a "Night With The Bears" April 7, 2009 in Toronto, a speaker's series organized by Sprott Asset Management. Guests include Eric Sprott, Meredith Whitney of Meredith Whitney Advisory Group, Nouriel Roubini of New York University and Ian Gordon, author of The Long Wave Analyst newsletters. My invitation said this is the first time these "four spectacular Bears", (Roubini, Sprott, Whitney and Gordon) will be together on stage discussing the economy

A packed house gasped as "lunatic fringe" cycle expert Ian Gordon predicted the Dow Industrials would hit 1000 before this downturn is over. Gordon's analysis is based on the Kondratiev long wave or K-wave which spans about 50+ years as measured from trough to trough.

So as investors we must fear the worst - avoid any type of risk - don't invest - don't buy a house - don't change jobs - don't trust anyone - don't borrow - don't believe in our way of life - hide or you get H1N1

The following is a quote from the classic publication, Reminiscences of a Stock Operator by Edwin Lefavre

Among the hazards of speculation the happening of the unexpected – I might even say of the un-expectable - ranks high. There are certain chances that the most prudent man is justified in taking – chances that he must take if he wishes to be more than a mercantile mollusc. Normal business hazards are no worse than the risk a man runs when he goes out of his house into the street or sets out on a railway journey. When I lose money by reason of some development which nobody could foresee I think no more vindictively of it than I do of an inconveniently timed storm.

Life itself from the cradle to the grave is a gamble and what happens to me because I do not possess the gift of second sight I can bear undisturbed.

I rest my case.

According to http://en.wikipedia.org/wiki/Fear_mongering - fear mongering (or scaremongering) is the use of fear to influence the opinions and actions of others towards some specific end. The feared object or subject is sometimes exaggerated, and the pattern of fear mongering is usually one of repetition, in order to continuously reinforce the intended effects of this tactic.

Inciting fear is a technique to gain notoriety and influence. Some financial advisors and money managers use fear mongering as a means to prospect for new clients - to attract investors to the safely of their enterprise and away from their current and dangerous advisor.

I recall a "Night With The Bears" April 7, 2009 in Toronto, a speaker's series organized by Sprott Asset Management. Guests include Eric Sprott, Meredith Whitney of Meredith Whitney Advisory Group, Nouriel Roubini of New York University and Ian Gordon, author of The Long Wave Analyst newsletters. My invitation said this is the first time these "four spectacular Bears", (Roubini, Sprott, Whitney and Gordon) will be together on stage discussing the economy

A packed house gasped as "lunatic fringe" cycle expert Ian Gordon predicted the Dow Industrials would hit 1000 before this downturn is over. Gordon's analysis is based on the Kondratiev long wave or K-wave which spans about 50+ years as measured from trough to trough.

So as investors we must fear the worst - avoid any type of risk - don't invest - don't buy a house - don't change jobs - don't trust anyone - don't borrow - don't believe in our way of life - hide or you get H1N1

The following is a quote from the classic publication, Reminiscences of a Stock Operator by Edwin Lefavre

Among the hazards of speculation the happening of the unexpected – I might even say of the un-expectable - ranks high. There are certain chances that the most prudent man is justified in taking – chances that he must take if he wishes to be more than a mercantile mollusc. Normal business hazards are no worse than the risk a man runs when he goes out of his house into the street or sets out on a railway journey. When I lose money by reason of some development which nobody could foresee I think no more vindictively of it than I do of an inconveniently timed storm.

Life itself from the cradle to the grave is a gamble and what happens to me because I do not possess the gift of second sight I can bear undisturbed.

I rest my case.

Monday, November 9, 2009

The pot calling the kettle black

Sean left a new comment on your post " For GT Blog October 25, 2009":

Kudos Bill. I love your site and subscribe via RSS on myYahoo. I also have a soft spot for your analysis because you - like me - still us Supercharts, even though there are far more fanciful packages available. I have made the same criticisms to colleagues and have not renewed for 8 years because of the chicanery. The last meeting I went to was "guest led" by a Montreal businessman that hounded me for a subscription for years. I would like to point out, however, that your site is not immune from vendorville, as you have Google ads (the latest one promises 700% stock picks) on your site. Remove these and your credibility goes up even further in my view.

GT's reply

Hello Sean

Some very good points - the Google ads on my blog site do have a "sleeze" factor and they will be removed along with other changes to GT's web site. I am going a step further and removing any links or connection to any site or blog posing to be independent and then acting as a shill for advisors trolling for clients. Unfortunately Don Vialoux and his daily reports on timingthemarket.ca has taken this unfortunate path in accepting sponsorship from Castlemoore Inc an advisor who is trolling for clients

Bill Carrigan

Kudos Bill. I love your site and subscribe via RSS on myYahoo. I also have a soft spot for your analysis because you - like me - still us Supercharts, even though there are far more fanciful packages available. I have made the same criticisms to colleagues and have not renewed for 8 years because of the chicanery. The last meeting I went to was "guest led" by a Montreal businessman that hounded me for a subscription for years. I would like to point out, however, that your site is not immune from vendorville, as you have Google ads (the latest one promises 700% stock picks) on your site. Remove these and your credibility goes up even further in my view.

GT's reply

Hello Sean

Some very good points - the Google ads on my blog site do have a "sleeze" factor and they will be removed along with other changes to GT's web site. I am going a step further and removing any links or connection to any site or blog posing to be independent and then acting as a shill for advisors trolling for clients. Unfortunately Don Vialoux and his daily reports on timingthemarket.ca has taken this unfortunate path in accepting sponsorship from Castlemoore Inc an advisor who is trolling for clients

Bill Carrigan

Tuesday, November 3, 2009

Cycle Summation

For GT Blog November 03, 2009

Hello fellow bloggers

The current corrective period that began with the cyclic peak of the TSX Financial Index on September 30, 2009 is frustrating the bulls and giving the bears more hope for the big down so they can finally get long and participate in the current bull market

Some cycle work of the late, great Ian S. Notley as set out in his May 1995 publication Cycles And Methodology may provide some clarity during noisy and confusing periods such as now – so let us look firstly at the longer term monthly cycle

The longer term cycle is monitored on the charts by investors using monthly observations with one cyclic bottom juncture approximately every 4 to 4 ½ +/- years. The bull phase generally persists for 28 + /- months duration and the bear phases are generally of 15 +/- months duration. The origin of the last juncture was a bear trough in most of the major stock indices on April 30, 2009 thus aging the current bull at only 6 months.

The shorter intermediate term cycle is monitored on the charts by traders using weekly observations. The intermediate trend cycles are measured trough to trough and are 20 +/- weeks apart. There are about three intermediate trend junctures per calendar year (one bottom and two tops or two tops and one bottom). The bull skew is 12+/- weeks and the bear skew is 8+/- weeks. The origin of the last juncture was the October 2 peak in most of the major stock indices – aging the current bear skew at 4 weeks.

The very short term cycle is monitored on the charts by speculators for trading OR by traders and investors seeking to time the entry and exit of the weekly and monthly top and bottom junctures. The very short term trend cycles as measured from trough to trough are about 39+/- days apart with the bear skew spanning about 14 +/- days. The origin of the last juncture was the October 23 peak in most of the major stock indices – aging the current bear skew at 8 days

Now with our three cyclic positions mapped out we can plot a course for the broader equity markets over the next several weeks

Over the next 4 to 6 trading days the very short term daily cycle will trough and exert upward pressure on the current bear skew of the intermediate weekly cycle. By mid November the intermediate cycle will trough and set up a condition we call summed cyclicality which is the sum of the movements of all three market rhythms – in this case upward for at least 12 weeks taking us to the peak of the next intermediate cycle sometime in mid to late January 2010

So get long and enjoy

Hello fellow bloggers

The current corrective period that began with the cyclic peak of the TSX Financial Index on September 30, 2009 is frustrating the bulls and giving the bears more hope for the big down so they can finally get long and participate in the current bull market

Some cycle work of the late, great Ian S. Notley as set out in his May 1995 publication Cycles And Methodology may provide some clarity during noisy and confusing periods such as now – so let us look firstly at the longer term monthly cycle

The longer term cycle is monitored on the charts by investors using monthly observations with one cyclic bottom juncture approximately every 4 to 4 ½ +/- years. The bull phase generally persists for 28 + /- months duration and the bear phases are generally of 15 +/- months duration. The origin of the last juncture was a bear trough in most of the major stock indices on April 30, 2009 thus aging the current bull at only 6 months.

The shorter intermediate term cycle is monitored on the charts by traders using weekly observations. The intermediate trend cycles are measured trough to trough and are 20 +/- weeks apart. There are about three intermediate trend junctures per calendar year (one bottom and two tops or two tops and one bottom). The bull skew is 12+/- weeks and the bear skew is 8+/- weeks. The origin of the last juncture was the October 2 peak in most of the major stock indices – aging the current bear skew at 4 weeks.

The very short term cycle is monitored on the charts by speculators for trading OR by traders and investors seeking to time the entry and exit of the weekly and monthly top and bottom junctures. The very short term trend cycles as measured from trough to trough are about 39+/- days apart with the bear skew spanning about 14 +/- days. The origin of the last juncture was the October 23 peak in most of the major stock indices – aging the current bear skew at 8 days

Now with our three cyclic positions mapped out we can plot a course for the broader equity markets over the next several weeks

Over the next 4 to 6 trading days the very short term daily cycle will trough and exert upward pressure on the current bear skew of the intermediate weekly cycle. By mid November the intermediate cycle will trough and set up a condition we call summed cyclicality which is the sum of the movements of all three market rhythms – in this case upward for at least 12 weeks taking us to the peak of the next intermediate cycle sometime in mid to late January 2010

So get long and enjoy

Wednesday, October 28, 2009

For GT Blog October 28, 2009

Don Vialoux has removed me from his mailing list in reaction to my CSTA rant last week. I will miss Don's analysis because I have an interest in the TSX listed Tim Hortons Inc. (THI) which would hopefully pass three of Don’s tests – seasonality – fundamentals and the technicals. I am weak on the seasonal and fundamental issues so I will give it a try – some feedback would help

Seasonality

Seasonal affective disorder (SAD) takes its toll on millions of North Americans each year, a condition that leads to depression, anxiety, and chronic fatigue as the winter months ensue. It's one reason why people migrate to sunnier quarters during winter season – or in the alternative remain in Canada and eat more donuts.

Fundamentals

A simple observation of the Hortons’ drive through any morning clearly shows that Canadians love their morning coffee and donuts. When the Hortons’ medium coffee cup is examined for volume it is clearly less than the McDonald's medium cup – at about the same price – this tells me Hortons’ make more money per serving – (personally I like the McDonald’s coffee)

The Technicals

The chart below displays a huge symmetrical triangle which tends to precede a major move – up or down. The lower study is a relative analysis test which is showing recent improvement in THI vs the TSX Composite. Hortons is also a “safe” place to hide when investors seek to leave the riskier assets – watch for the break to the upside

Seasonality

Seasonal affective disorder (SAD) takes its toll on millions of North Americans each year, a condition that leads to depression, anxiety, and chronic fatigue as the winter months ensue. It's one reason why people migrate to sunnier quarters during winter season – or in the alternative remain in Canada and eat more donuts.

Fundamentals

A simple observation of the Hortons’ drive through any morning clearly shows that Canadians love their morning coffee and donuts. When the Hortons’ medium coffee cup is examined for volume it is clearly less than the McDonald's medium cup – at about the same price – this tells me Hortons’ make more money per serving – (personally I like the McDonald’s coffee)

The Technicals

The chart below displays a huge symmetrical triangle which tends to precede a major move – up or down. The lower study is a relative analysis test which is showing recent improvement in THI vs the TSX Composite. Hortons is also a “safe” place to hide when investors seek to leave the riskier assets – watch for the break to the upside

Sunday, October 25, 2009

For GT Blog October 25, 2009

I am still done with the CSTA in spite of Don Vialoux’s opinion that my comments were “over the top and not in (my) best interests.”

The reality is the CSTA is the only professional organisation that allows industry professional members to use the resources of their organisation (the CSTA) for the purpose of soliciting, urging, requesting, enticing or otherwise promoting their services to individual investors.

I know because I attended many public CSTA promotions at various financial forums and witnessed CSTA members pimping their services to private investors who were initially curious about the benefits of membership. A classic bait and switch technique.

The foxes ambushing the chickens

Log on to www.advocis.ca - The Financial Advisors Association of Canada - a platform of knowledge, advocacy, community and protection enhancing the professionalism of financial advisors and planners in the best interest of the consumer. Only industry professionals can be members - scan the list of directors – no contact info – with the exception of name@advocis.ca

Scan the list of CSTA directors – the contact info is directed to their personal business enterprise. Some of the directors email reply names are almost egregious – not suitable for a professional organisation - some examples "Wi$eMoney.ca" and “analyzingmarkets.com” – only one director has non predatory contact information - Deborah Shaman, Ottawa Regional Director - ottawa@csta.org

The foxes ambushing the chickens

One would wonder why an industry pro who may - or may not have any accreditation or reputation of being a technical analyst would worm their way onto the list of CSTA directors. There can be only two answers – firstly it is an easy way to add some impressive stuff to their resumes – something like “Billy Bob is past President (or) former director of the Canadian Society of Technical Analysts (CSTA)”.

Secondly why would a director want to post all of their professional contact information on a busy web site?

The foxes ambushing the chickens

This predatory behaviour only adds to the public perception that technical analysis is “voodoo science” or “lunatic fringe” activity. The fact that holding a CMT does little to impress the regulators or the financial services industry as to accreditation is a serious problem for the profession. That is why some CMT’s will also acquire a CFA or CIM to ensure employment opportunity

Now before all you CMTs out there complain - go to Advocis / find an advisor http://www.advocis.ca/content/find-ad-form.aspx and look at the search - Financial designation options CFA, CFP, CH.F.C, CIM, CLU, CMP, R.F.P, REBC, RHU and TEP – no CMT found here

There is more – look at IIROC the list CE Accredited Courses for Cycle 4 (2009-2011) Professional Development - IIROC is the national self-regulatory organization which oversees all investment dealers and trading activity on debt and equity marketplaces in Canada - the link:

http://cecap.ca/cy4//en/index.php?pageNum_pd_c3_members=0&totalRows_pd_c3_members=66&mod=providers_pdc3&cyc=04&cat_type=PD

No mention of the CSTA here but one can get 4 credits by watching a presentation by Thomson Reuters Markets Academy

Don I know you were – and I quote - “sad about Bill’s comments for a number of reasons: The comments were not specific. More information about his concerns are needed by the CSTA board before it can respond.”

So there you go – specifically yours – Bill Carrigan

The reality is the CSTA is the only professional organisation that allows industry professional members to use the resources of their organisation (the CSTA) for the purpose of soliciting, urging, requesting, enticing or otherwise promoting their services to individual investors.

I know because I attended many public CSTA promotions at various financial forums and witnessed CSTA members pimping their services to private investors who were initially curious about the benefits of membership. A classic bait and switch technique.

The foxes ambushing the chickens

Log on to www.advocis.ca - The Financial Advisors Association of Canada - a platform of knowledge, advocacy, community and protection enhancing the professionalism of financial advisors and planners in the best interest of the consumer. Only industry professionals can be members - scan the list of directors – no contact info – with the exception of name@advocis.ca

Scan the list of CSTA directors – the contact info is directed to their personal business enterprise. Some of the directors email reply names are almost egregious – not suitable for a professional organisation - some examples "Wi$eMoney.ca" and “analyzingmarkets.com” – only one director has non predatory contact information - Deborah Shaman, Ottawa Regional Director - ottawa@csta.org

The foxes ambushing the chickens

One would wonder why an industry pro who may - or may not have any accreditation or reputation of being a technical analyst would worm their way onto the list of CSTA directors. There can be only two answers – firstly it is an easy way to add some impressive stuff to their resumes – something like “Billy Bob is past President (or) former director of the Canadian Society of Technical Analysts (CSTA)”.

Secondly why would a director want to post all of their professional contact information on a busy web site?

The foxes ambushing the chickens

This predatory behaviour only adds to the public perception that technical analysis is “voodoo science” or “lunatic fringe” activity. The fact that holding a CMT does little to impress the regulators or the financial services industry as to accreditation is a serious problem for the profession. That is why some CMT’s will also acquire a CFA or CIM to ensure employment opportunity

Now before all you CMTs out there complain - go to Advocis / find an advisor http://www.advocis.ca/content/find-ad-form.aspx and look at the search - Financial designation options CFA, CFP, CH.F.C, CIM, CLU, CMP, R.F.P, REBC, RHU and TEP – no CMT found here

There is more – look at IIROC the list CE Accredited Courses for Cycle 4 (2009-2011) Professional Development - IIROC is the national self-regulatory organization which oversees all investment dealers and trading activity on debt and equity marketplaces in Canada - the link:

http://cecap.ca/cy4//en/index.php?pageNum_pd_c3_members=0&totalRows_pd_c3_members=66&mod=providers_pdc3&cyc=04&cat_type=PD

No mention of the CSTA here but one can get 4 credits by watching a presentation by Thomson Reuters Markets Academy

Don I know you were – and I quote - “sad about Bill’s comments for a number of reasons: The comments were not specific. More information about his concerns are needed by the CSTA board before it can respond.”

So there you go – specifically yours – Bill Carrigan

Wednesday, October 21, 2009

For GT Blog October 22, 2009

I am done with the CSTA

The CSTA (Canadian Society of Technical Analysts) claim their mission to be “To promote Technical Analysis at both academic and professional levels, through education and the sharing of knowledge with the community of technical analysts and the investment industry, and through the establishment and fostering of the highest standards.”

When I became a member several years ago I assumed the CSTA to be a professional organization on a par with peers such as Certified Financial Planner Board of Standards, the CFA Institute, the Financial Planners Standards Council and The Financial Advisors Association of Canada (Advocis)

Dig this mission statement from Advocis, “The Financial Advisors Association of Canada provides a platform of knowledge, advocacy, community and protection enhancing the professionalism of financial advisors and planners in the best interest of the consumer.”

The bottom line, the private investor is the direct beneficiary of these professional organizations because they know - in the long run – when investors are well served – their profession is also well served – everybody wins

I have in the past made several public presentations on behalf of the CSTA with a view to encourage industry pros and private investors to incorporate some form of technical analysis into their investment strategy. My last presentation was at the June 2009 CSTA annual meeting in Toronto.

I have always held myself out to be an educator and not salesman looking for new business - Unfortunately over the past few years the CSTA has morphed into a shill or platform for industry salesmen to fish for new clients - the board of directors is littered with salesmen who seek to use the organisation as a platform to promote their own self interests

So here is my challenge to the CSTA - a new rule

No member of the CSTA shall use the organisation to promote their own self-serving agenda - this would forbid industry professionals from using the CSTA platform for interaction with private investors and the business media to promote their own personal business enterprises

Do this and I bet one-third of the directors would resign

Do this and I would reconsider my membership

Bill Carrigan

The CSTA (Canadian Society of Technical Analysts) claim their mission to be “To promote Technical Analysis at both academic and professional levels, through education and the sharing of knowledge with the community of technical analysts and the investment industry, and through the establishment and fostering of the highest standards.”

When I became a member several years ago I assumed the CSTA to be a professional organization on a par with peers such as Certified Financial Planner Board of Standards, the CFA Institute, the Financial Planners Standards Council and The Financial Advisors Association of Canada (Advocis)

Dig this mission statement from Advocis, “The Financial Advisors Association of Canada provides a platform of knowledge, advocacy, community and protection enhancing the professionalism of financial advisors and planners in the best interest of the consumer.”

The bottom line, the private investor is the direct beneficiary of these professional organizations because they know - in the long run – when investors are well served – their profession is also well served – everybody wins

I have in the past made several public presentations on behalf of the CSTA with a view to encourage industry pros and private investors to incorporate some form of technical analysis into their investment strategy. My last presentation was at the June 2009 CSTA annual meeting in Toronto.

I have always held myself out to be an educator and not salesman looking for new business - Unfortunately over the past few years the CSTA has morphed into a shill or platform for industry salesmen to fish for new clients - the board of directors is littered with salesmen who seek to use the organisation as a platform to promote their own self interests

So here is my challenge to the CSTA - a new rule

No member of the CSTA shall use the organisation to promote their own self-serving agenda - this would forbid industry professionals from using the CSTA platform for interaction with private investors and the business media to promote their own personal business enterprises

Do this and I bet one-third of the directors would resign

Do this and I would reconsider my membership

Bill Carrigan

Friday, October 16, 2009

For GT Blog October 10, 2009

More on investment myths and investment folklore

It has taken me years to discover that low investment costs such as cheap trading commissions and low management fees have little to do with successful investing – those low trading fees can encourage over-trading resulting in you “giving away” good stocks because of the removed commission barrier.

During the 2007-2008 financial melt-down those low MER exchange traded funds collapsed at the same rate as their more expensive mutual fund peers – does saving the extra 1.5% fee make you feel better when your down 35%?

The reality is most of your investment returns are determined by bull & bear markets, proper sector selection and the current dominant theme

The dominant theme will lead a secular up-trend which is a long-term trend that can persist for several years. These long trends are interrupted by the shorter, four-year bull and bear cycle, hence the term “secular trend.’

The first modern secular uptrend was the post-World War II boom of 1949 through 1966. It ended when the Nifty Fifty buy-and-hold asset bubble popped in response to rising oil prices. This introduced the first modern secular downtrend that persisted though the 1970s. The crisis was the 1973 Arab Oil Embargo.

In the early 1980s, the new-economy companies took flight and the great 1982-2000 second modern secular uptrend was on. All investors had to do was buy and hold. Today, the tech-laden Nasdaq composite at the 2,000 level is still ten times the 1982 level of under 200 on the index.

In the late 1990’s savvy investors enjoyed the energy theme which ended with the great crude spike of 2008 - a ten-year run that drove the TSX Energy index from a 1998 low of 50 to a 2008 peak of 470 – up over 800% for a 10-year annualized return of over 25%

Clearly we need a new dominant theme

I will be a presenter at the World MoneyShow Toronto - Metro Toronto Convention Centre Thursday October 22, 2009 from 4:15 pm to 5 pm. I will explain secular trends and seek out the new dominant investment theme.

I invite you to join me - follow this link for more information http://www.moneyshow.com/toms/wBios.asp?id=1155FT1

It has taken me years to discover that low investment costs such as cheap trading commissions and low management fees have little to do with successful investing – those low trading fees can encourage over-trading resulting in you “giving away” good stocks because of the removed commission barrier.

During the 2007-2008 financial melt-down those low MER exchange traded funds collapsed at the same rate as their more expensive mutual fund peers – does saving the extra 1.5% fee make you feel better when your down 35%?

The reality is most of your investment returns are determined by bull & bear markets, proper sector selection and the current dominant theme

The dominant theme will lead a secular up-trend which is a long-term trend that can persist for several years. These long trends are interrupted by the shorter, four-year bull and bear cycle, hence the term “secular trend.’

The first modern secular uptrend was the post-World War II boom of 1949 through 1966. It ended when the Nifty Fifty buy-and-hold asset bubble popped in response to rising oil prices. This introduced the first modern secular downtrend that persisted though the 1970s. The crisis was the 1973 Arab Oil Embargo.

In the early 1980s, the new-economy companies took flight and the great 1982-2000 second modern secular uptrend was on. All investors had to do was buy and hold. Today, the tech-laden Nasdaq composite at the 2,000 level is still ten times the 1982 level of under 200 on the index.

In the late 1990’s savvy investors enjoyed the energy theme which ended with the great crude spike of 2008 - a ten-year run that drove the TSX Energy index from a 1998 low of 50 to a 2008 peak of 470 – up over 800% for a 10-year annualized return of over 25%

Clearly we need a new dominant theme

I will be a presenter at the World MoneyShow Toronto - Metro Toronto Convention Centre Thursday October 22, 2009 from 4:15 pm to 5 pm. I will explain secular trends and seek out the new dominant investment theme.

I invite you to join me - follow this link for more information http://www.moneyshow.com/toms/wBios.asp?id=1155FT1

Tuesday, October 13, 2009

For GT Blog October 14, 2009

Rickyisms is the term devised by the fans of Trailer Park Boys for Ricky's malapropisms. They are often used due to poor education, extensive drug and alcohol use, and situations where he may not be thinking clearly

Example; "Get two birds stoned at the same time" instead of "kill two birds with the same stone"

I have recently picked up on Dennis Gartman and his Gartmanisms.

Dig these classics, "In bull markets we can only be long or neutral, and in bear markets we can only be short or neutral. That may seem self-evident; it is not, and it is a lesson learned too late by far too many" - so we can be neutral all the time?

"All rules are meant to be broken: The trick is knowing when... and how infrequently this rule may be invoked!" - say what?

"I am currently short the U.S. dollar and long the Canadian dollar" - a double short?

"I am long gold but I do not like gold, sorry gold bugs" - either way he wins.

Gartman also thinks the rising Canadian loonie is great for Canadians - I wonder which Canadians that could be - certainly not Alberta's energy industry and not Ontario's gutted manufactures - sorry I forgot there are some benefits to a strong loonie - vacations to Barbados and the big Chinese importers like Canadian Tire.

Example; "Get two birds stoned at the same time" instead of "kill two birds with the same stone"

I have recently picked up on Dennis Gartman and his Gartmanisms.

Dig these classics, "In bull markets we can only be long or neutral, and in bear markets we can only be short or neutral. That may seem self-evident; it is not, and it is a lesson learned too late by far too many" - so we can be neutral all the time?

"All rules are meant to be broken: The trick is knowing when... and how infrequently this rule may be invoked!" - say what?

"I am currently short the U.S. dollar and long the Canadian dollar" - a double short?

"I am long gold but I do not like gold, sorry gold bugs" - either way he wins.

Gartman also thinks the rising Canadian loonie is great for Canadians - I wonder which Canadians that could be - certainly not Alberta's energy industry and not Ontario's gutted manufactures - sorry I forgot there are some benefits to a strong loonie - vacations to Barbados and the big Chinese importers like Canadian Tire.

Thursday, October 8, 2009

For GT Blog October 10, 2009

I often laugh-out-loud (LOL) when a “portfolio manager” is a guest on a business TV show – be it CNBC, BNN or CBC – they talk fundamental stuff like ROE, the balance sheet, the earnings outlook, the dividend coverage, the book value all “going forward” of course. Then they slip and make a technical comment – “there is support at” or “just over the 50-day” they snap out of it and quickly get back to gross margins.

The only reason I got my CIM designation was because I need to know how these guys think. Basically they all get sucked in by the compelling storeys served to them by the companies they “investigate”. It is not about lying – it is about misinformation or the lack of truth. Do the analysts and the auditors ever really know what those assets are worth? I recall Allen-Vanguard Corp at $10 (now worth nothing) being very focused on Iraq and roadside bombs.- winning contracts and there was great optimism that big sales will continue and big earnings to come. Don’t get me started on Timminco Ltd

As a technician I believe the worst – the companies misinform the auditors, the auditors misinform the banks, the banks pass the misinformation to their analysts who misinform the portfolio managers who get on TV and misinform the viewers.

The bottom line is the smart money always wins – the smart money gets in first and gets out first – you and I will never be the first to know – our only defence to follow the money and ignore those compelling stories

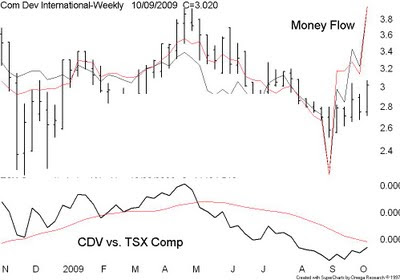

I bought some COM DEV (TSX-CDV) last week because of the soaring money flow numbers – CON DEV is manufacturer and distributor of space communications and space science products – I have no idea of the outlook for the company - only the insiders know that - I am just following the money honey

The only reason I got my CIM designation was because I need to know how these guys think. Basically they all get sucked in by the compelling storeys served to them by the companies they “investigate”. It is not about lying – it is about misinformation or the lack of truth. Do the analysts and the auditors ever really know what those assets are worth? I recall Allen-Vanguard Corp at $10 (now worth nothing) being very focused on Iraq and roadside bombs.- winning contracts and there was great optimism that big sales will continue and big earnings to come. Don’t get me started on Timminco Ltd

As a technician I believe the worst – the companies misinform the auditors, the auditors misinform the banks, the banks pass the misinformation to their analysts who misinform the portfolio managers who get on TV and misinform the viewers.

The bottom line is the smart money always wins – the smart money gets in first and gets out first – you and I will never be the first to know – our only defence to follow the money and ignore those compelling stories

I bought some COM DEV (TSX-CDV) last week because of the soaring money flow numbers – CON DEV is manufacturer and distributor of space communications and space science products – I have no idea of the outlook for the company - only the insiders know that - I am just following the money honey

Monday, October 5, 2009

For GT Blog October 5, 2009

In the early 1960's I was an engineering student at Ryerson University in Toronto and I had aspirations of being an acoustical engineer. A local company was introducing a radical new bass enclosure they referred to as an Acoustic Filter

When I asked the designer for the design theory he replied "why would I spend ten minutes to give away ten years of experiments?"

A few years ago the Canadian Society of Technical Analysts asked me to present the theory behind my sector rotation models. When I declined a wise old gentleman took me aside and said, "not to worry - you could explain the secret of eternal life to 1000 attendees and only one would listen!"

I gave the presentation - and the old man was right, my revelations had no cosmic effect

So with that in mind I now share another little secret of market timing using technical analysis: - the small caps lead the large caps. That is why I include the iShares CDN Small Cap ETF (XCS) in my weekly sector rotation tables. When the small caps are higher ranked than the broader iShares CDN S&P/TSX60 ETF (XIU) I get bullish and when the smaller caps rank under the large caps - I get bearish

Our chart below displays the TSX Small Caps over the TSX Large Caps - the bottom indicator is the relative perform which clearly sets out the leadership of the smaller companies - note also the higher March 2009 lows of the smaller caps

The economy sensitive smaller companies lead the way - up and down

When I asked the designer for the design theory he replied "why would I spend ten minutes to give away ten years of experiments?"

A few years ago the Canadian Society of Technical Analysts asked me to present the theory behind my sector rotation models. When I declined a wise old gentleman took me aside and said, "not to worry - you could explain the secret of eternal life to 1000 attendees and only one would listen!"

I gave the presentation - and the old man was right, my revelations had no cosmic effect

So with that in mind I now share another little secret of market timing using technical analysis: - the small caps lead the large caps. That is why I include the iShares CDN Small Cap ETF (XCS) in my weekly sector rotation tables. When the small caps are higher ranked than the broader iShares CDN S&P/TSX60 ETF (XIU) I get bullish and when the smaller caps rank under the large caps - I get bearish

Our chart below displays the TSX Small Caps over the TSX Large Caps - the bottom indicator is the relative perform which clearly sets out the leadership of the smaller companies - note also the higher March 2009 lows of the smaller caps

The economy sensitive smaller companies lead the way - up and down

Wednesday, September 30, 2009

For GT Blog October 1, 2009

Dilemma - a noun pronounced [di-lem-uh] meaning a situation requiring a choice between two equally undesirable alternatives. The great stock market advance that began in early March 2009 has set up an investment dilemma for both the bulls and the bears.

Bearish investors assumed the great advance to be a sucker bear market rally and sat in cash alternatives waiting for a major correction - possibly back down to re-test the March 2009 lows. Dilemma, do they capitulate and buy in now and risk a correction or do they sit in cash and wait for a correction that may never materialize?

Bullish investors who enjoyed the advance assume it is a youthful bull market and fear not to remain invested. They also fear that a correction could wipe away much of their March to date returns. Dilemma, do they sell now and try to re-enter at lower prices that may never materialize or do they hold and remain fully invested and risk a correction?

We need to decide, is this a bull market or - is this a bear market? Solve that and we resolve the dilemma. If a bull market the bears should buy in now and the bulls should remain fully invested. If we still have a bear market the bears will stay in cash and await the correction and the bulls will sell and lock in those bear rally profits.

Perhaps some historical data on bull and bear markets will help when we examine the duration of the bull and bear cycle over the past 100 years.

The average duration of a bear market in months is 14-months with the longest modern bear of 1973-74 running almost 24 months. If you're a bear we are now into 24-months from the peak of October 2007. Clearly the math does not support a current bear environment.

The average duration of a bull market in months is 24-months with the longest modern bull of 1990-1998 spanning 94 months. If you're a bull we are now only 6-months from the bottom of March 2009 and so the math does not support the end of the current bull.

The other issue to support the bull market scenario is the growing number of new 52-week highs in many of the important stock sectors. Yesterday stocks listed on the Nasdaq, the NYSE and the TSX posted over 200 new highs and only 14 new 52-week lows. As we move into October most of the broader indices are approaching new 52-weeks highs. The Nasdaq is currently within 2% of the October 2008 peak and above the November 2008 peak. The all important Russell 2000 is still 15% below the October 2008 peak but above the November 2008 peak.

Our chart below looks at the TSX Composite and the Nasdaq October 2008 price targets - if these 52-week targets are overcome, the bears will capitulate and trigger a bullish stampede into equities.

Closing In - 52-week Price Targets on the TSX Comp and the Nasdaq

Bearish investors assumed the great advance to be a sucker bear market rally and sat in cash alternatives waiting for a major correction - possibly back down to re-test the March 2009 lows. Dilemma, do they capitulate and buy in now and risk a correction or do they sit in cash and wait for a correction that may never materialize?

Bullish investors who enjoyed the advance assume it is a youthful bull market and fear not to remain invested. They also fear that a correction could wipe away much of their March to date returns. Dilemma, do they sell now and try to re-enter at lower prices that may never materialize or do they hold and remain fully invested and risk a correction?

We need to decide, is this a bull market or - is this a bear market? Solve that and we resolve the dilemma. If a bull market the bears should buy in now and the bulls should remain fully invested. If we still have a bear market the bears will stay in cash and await the correction and the bulls will sell and lock in those bear rally profits.

Perhaps some historical data on bull and bear markets will help when we examine the duration of the bull and bear cycle over the past 100 years.

The average duration of a bear market in months is 14-months with the longest modern bear of 1973-74 running almost 24 months. If you're a bear we are now into 24-months from the peak of October 2007. Clearly the math does not support a current bear environment.

The average duration of a bull market in months is 24-months with the longest modern bull of 1990-1998 spanning 94 months. If you're a bull we are now only 6-months from the bottom of March 2009 and so the math does not support the end of the current bull.

The other issue to support the bull market scenario is the growing number of new 52-week highs in many of the important stock sectors. Yesterday stocks listed on the Nasdaq, the NYSE and the TSX posted over 200 new highs and only 14 new 52-week lows. As we move into October most of the broader indices are approaching new 52-weeks highs. The Nasdaq is currently within 2% of the October 2008 peak and above the November 2008 peak. The all important Russell 2000 is still 15% below the October 2008 peak but above the November 2008 peak.

Our chart below looks at the TSX Composite and the Nasdaq October 2008 price targets - if these 52-week targets are overcome, the bears will capitulate and trigger a bullish stampede into equities.

Closing In - 52-week Price Targets on the TSX Comp and the Nasdaq

Monday, September 28, 2009

For GT Blog September 29, 2009

Hello fellow bloggers and stock market participants.

As you know RIM last Thursday announced continued earnings growth but warned on the potential for future pressure on margins - At the open on Friday the stock torpedoed but the broader stock indices shrugged off the bad news and continued higher.

The shares of competitor Apple Inc. are now higher than last Thursday's close

Lets us have some fun with a skill test to see if you can spot the early warnings of a RIM torpedo by spotting the early signs of negative price divergence as set up in an Apple over RIM weekly chart

Apple is stronger than RIM as measured from A to B, C to D or D to E

RIM is weaker than Apple as measured from A to B, C to D or D to E

Which stock would you buy - right now?

To learn the correct answer attend our Technical Analysis Level 1 or 2 seminar - to register go to: http://www.gettingtechnical.com/07_seminars/index.shtml

As you know RIM last Thursday announced continued earnings growth but warned on the potential for future pressure on margins - At the open on Friday the stock torpedoed but the broader stock indices shrugged off the bad news and continued higher.

The shares of competitor Apple Inc. are now higher than last Thursday's close

Lets us have some fun with a skill test to see if you can spot the early warnings of a RIM torpedo by spotting the early signs of negative price divergence as set up in an Apple over RIM weekly chart

Apple is stronger than RIM as measured from A to B, C to D or D to E

RIM is weaker than Apple as measured from A to B, C to D or D to E

Which stock would you buy - right now?

To learn the correct answer attend our Technical Analysis Level 1 or 2 seminar - to register go to: http://www.gettingtechnical.com/07_seminars/index.shtml

Two Smartphone Bellwethers

Tuesday, September 22, 2009

For GT Blog September 22, 2009

Let’s listen in on an advisor – client conversation

Advisor: Wow this market is really strong!

Client: How strong is it?

Advisor: It is so strong none of the O’Leary funds have made a new 52-week low since last July.

I have been a bull since the lows of November 2008 when some important stocks such as IBM, Intel & Home Depot bottomed and later followed by the March lows of just about all of the major stock indices on the planet. We are now entering the seventh month of rising stock prices and not a day goes by when I am asked for technical evidence confirming the current bull.

Most bullish technicians will point to important leadership such as the Financial, Technology and Industrial sectors posting new 10-month highs followed closely by the Materials only 5% away from a new 52-week high. This along with the failure of the bears to take the market to new lows since March.

Last Monday I chaired a conference call with the Union Securities wealth management team who for the most part have enjoyed the 2009 bull market. We were once again reviewing the evidence to support our bullish stance when out of the blue one of the advisors asked a question about the wealth management companies

I had a moment of clarity – yes the wealth managers lead and I had overlooked these important bellwethers. The table below is a list of publicly traded Canadian wealth managers sorted by time from their last 52-week low. Half of the list bottomed in 2008 after peaking in mid 2006 and 2007 – I rest my case and kudos to the Union guy.

Advisor: Wow this market is really strong!

Client: How strong is it?

Advisor: It is so strong none of the O’Leary funds have made a new 52-week low since last July.

I have been a bull since the lows of November 2008 when some important stocks such as IBM, Intel & Home Depot bottomed and later followed by the March lows of just about all of the major stock indices on the planet. We are now entering the seventh month of rising stock prices and not a day goes by when I am asked for technical evidence confirming the current bull.

Most bullish technicians will point to important leadership such as the Financial, Technology and Industrial sectors posting new 10-month highs followed closely by the Materials only 5% away from a new 52-week high. This along with the failure of the bears to take the market to new lows since March.

Last Monday I chaired a conference call with the Union Securities wealth management team who for the most part have enjoyed the 2009 bull market. We were once again reviewing the evidence to support our bullish stance when out of the blue one of the advisors asked a question about the wealth management companies

I had a moment of clarity – yes the wealth managers lead and I had overlooked these important bellwethers. The table below is a list of publicly traded Canadian wealth managers sorted by time from their last 52-week low. Half of the list bottomed in 2008 after peaking in mid 2006 and 2007 – I rest my case and kudos to the Union guy.

Wednesday, September 16, 2009

For GT Blog September 17, 2009

Where is BNN’s Kevin O'Leary? I need to know because he was one of the best contrarian indicators on the street. I recall a March 4, 2009 BNN Squeeze Play O’Leary rant on General Electric Company (NYSE-GE - $6.69) to be a “worthless zombie stock”.

This of course was the setup for a classic buying opportunity. To-day 26-weeks later at $17 - GE is up 154% (that is 480% annualized).

We now need to know if Kevin O'Leary thinks the big March to September advance is a bull market or just a bear market sucker rally.

This is a need-to-know because our investment returns are not governed by seeking out “value” or discovering “the overlooked” or getting “inside information” or finding “cash rich” companies. The reality is bull markets boost the prices of all stocks – the good stuff and the crap – no matter, up they go and we are all expert stock pickers.

The bear market on the other hand takes everything down the toilet. The key is to recognize the bull and get long. Bears are for traders.