This

is a portion of an annoying item that appeared in the Globe ROB

PAUL BRENT - Special

to The Globe and Mail - Published Thursday, Oct. 04 2012

Quote:

“the chart and data-heavy approach of Peter Gibson, CIBC’s top-ranked head of

portfolio strategy and quantitative research, provides both a guide to

portfolio balancing and market timing.

The

basis of CIBC`s asset allocation strategy is deceptively simple. Since 1998,

every time bond yields fall, stock prices fall, and every time bond yields

rise, in general, stock prices also rise in lockstep. What CIBC tries to do is

predict the ceilings for the 10-year U.S. treasury bonds.

“The

bond yield ceiling right now is 3.65 [per cent],” Mr. Gibson said. “If the

bonds were to rise to that level then the stock market becomes overvalued and

then we have to switch our exposure back into bonds.”

CIBC

used this analysis to detect and act upon a buy signal for equities in 1998, a

sell signal at the beginning of 2000 during “the peak of the tech mania,” a buy

signal in October, 2002, and a sell signal again in June, 2007. CIBC also sent

out a buy signal in January of 2009, but “we were a little bit early,” he said.

What’s

important about the years 2000 and 2007, when the markets crashed, “was that at

the same time we were hitting the ceiling for bond yields, suggesting that bond

yields are too competitive with stocks. We also have falling profitability

because the Fed is tightening, trying to stop the bond yield from rising,” Mr.

Gibson explained.

“So

the return on investment begins to fall, meaning bond yields are too

competitive and corporate profitability is falling,” he said. “You have no

business being in the stock market.”

The

result was two stock market collapses of roughly 50 per cent. Meanwhile,

because bond yields were falling, bond prices rose and bond total returns rose

37 per cent while the market fell 50 per cent. In 2007-2008, the bond total

return was up 20 per cent while the stock market was down 57 per cent.

“This

is how we time the market,” Mr. Gibson explained.

“By

switching just five times, from 1998 to 2009 – stocks, bonds, stocks, bonds,

stocks – you are doing almost an 18 per cent per-annum return” in Canada, with

a rotating split between 100 per cent stocks and 100 per cent bonds, Mr. Gibson

said. “Basically you could play golf the rest of the time. It is because first

and foremost you have this positive correlation between bond yields and stock

prices.”

Stock

picking is less important with this strategy, given that 60 per cent of a total

return from individual stocks is a function of the market rising or falling,

not a stock`s fundamentals, CIBC states.

Today,

CIBC’s data shows “right now the stock market is incredibly cheap, based on the

level of interest rates,” he said, and CIBC is recommending that investors

should be overweight in stocks.

CIBC

had noticed in recent months that corporate profitability was beginning to fall

and predicted (rightly) that a co-ordinated program of quantitative easing

would occur in the Europe, China

and the United States.

“That

is what has lifted this market,” Mr. Gibson said. “It is due to a policy shift,

though. It is not due to strong and sustainable profit growth. If I had

sustainable profit growth with the interest rate picture that I have, I would

probably be talking about 1700 on the S&P.”

End

Quote:

Now

– back to reality. Aside from the arrogant insinuation that the “big boys” are

smarter than us “small boys”, market timing implies that investors should dump

their investments when they get a “sell” signal from some seasonal or black box

strategy and then buy them back when a “buy” signal is generated. In the

example of the CIBC model

Mr.

Gibson says “every time bond yields fall, stock prices fall, and every time

bond yields rise, in general, stock prices also rise in lockstep”.

There

is also one minor problem with the Gibson / CIBC timing model. If Peter Gibson only

joined CIBC in 2009 how could he be a component of any CIBC model buy and sell

signals from 1998 through 2009?

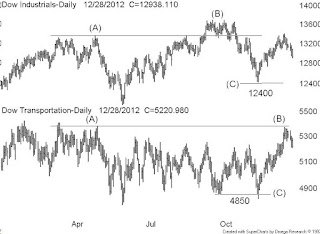

I

display a long term monthly data plot of the 10-year U.S. treasury bonds above the

S&P500 and I have marked the CIBC buy & sell signal with up & down

arrows. Note the 1992–1998 period where the relationship failed and note the

2010–2012 period where the relationship also failed.

This

timing model needs two things to work, firstly the yield vs. S&P500 signals

has to be a fact (which is questionable) and secondly you need to get the yield

(upper plot) buy & sell calls right as marked by those up & down

arrows. Are we to believe the CIBC got all those yield calls right? A posted

comment sums it all up: gazous - 1:32 PM on October 4, 2012 - easy enough,

after the fact....