His latest piece - last updated on Saturday, Mar. 27, 2010 “Almost all the things you don't like about mutual funds have been fixed in a new investing product called the actively managed exchange-traded fund.” I was curious to see his logic to support his profound “mutual funds have been fixed” claim.

Carrick leads with – “But now there's a different type of ETF – one that does exactly what conventional mutual funds do, but without the high cost and impediments to convenient buying and selling.

Question: Don’t all ETFs avoid the high cost and impediments to convenient buying and selling?

Carrick: - “Actively managed ETFs were introduced in Canada by Horizons AlphaPro in early 2009 and the reception was unenthusiastic. I wrote a column dissing them on the basis that many fund managers can't beat their benchmark indexes, a point that highlights the benefit of the traditional index-tracking ETF.

Question: So how come 12-months latter we now decide managers can beat their benchmark indexes?

Carrick: - “The actively managed ETF market has evolved in 2010, and so has my view. With some quality managers being recruited to run these ETFs, I think they have the potential to be one of the most significant retail investing developments in years.

Question: Aren’t these managers being recruited from the same fund industry that “needed to be fixed?”

Carrick: - “Subpar managers are easy to find in the mutual fund world – that's precisely why conventional index-tracking ETFs have become such a fast-growing product. But savvy investors know there are some managers who are worth putting to work in your portfolio. Actively managed ETFs are a smarter way to access these managers.

Question: If an active mutual fund manager is so good, why then work for less for an ETF manufacturer?

Carrick: - “Let's start with fees. The management expense ratios for five of the AlphaPro active ETFs is 1 per cent, while two others come in around 1.25 per cent. In addition, performance fees are charged if the funds beat specific benchmarks.

Question: How come Carrick fails to explain the 20% performance fee?

Carrick: - “A major reason why active ETFs cost less to own than mutual funds is that their fees do not include a component that is intended to compensate investment advisers for the counsel they provide clients. This so-called trailing commission accounts for one percentage point of the typical equity fund's MER and 0.5 points for the average bond fund.

Question: Is not a 1% trailer less than a 20% performance fee?

Carrick: - “Imagine you want to sell a fund with the market soaring at midday. You can do that with an actively managed ETF, whereas a fund exposes you to the risk that the market will pull back or even decline later in the day. When buying, you can take advantage of a dip to place your order.

Question: If the ETF is managed by a “quality manager”, how come we are now trading during “soaring at midday” and taking advantage of a dip to place your order? Are we not just to buy-and-hold and let the “quality manager” make those decisions?

Carrick: – “Because active ETFs are traded like stocks, you can use a limit order to set a ceiling on what you'll pay and a floor on what you'll accept when selling. You can also use a stop-loss order to liquidate your holding if the price falls through a certain threshold.”

Question: Are you suggesting we place restrictions such as ceilings and floors and stop losses on a “quality manager”?

Carrick: - “Here's a list of TSX-listed ETFs that use a manager to pick securities rather than following the traditional ETF strategy of tracking an index. All are part of the Horizons AlphaPro family.”

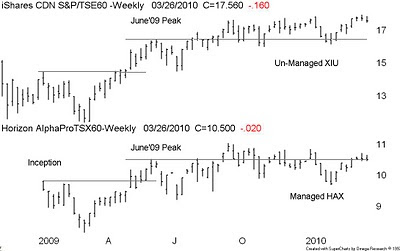

Question: If you can produce a list how come you don’t produce a track record?

By the way - Don Vialoux, Brooke Thackray, Dennis Gartman, Frank Mersch, Prakash Hariharan, Steve Rogers¸ Lyle Stein and Vito Maida are all sub-advisors to these products and not the fund managers as set out in the Carrick tables.