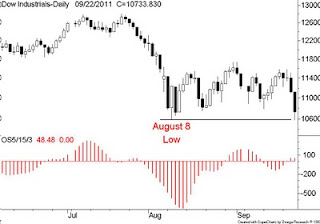

Now the good news – so far The Dow internals (breadth) are today in better shape than back in August 8 At quick look at the Dow 30 components and counting how many are above or below their relative August 8 lows As of 2.50 pm September 22, 2011 – I count only 8 (eight) components trading under their relative August 8 lows. The symbols: AA, BAC, CAT, DD, HPQ, JPM, MMM and TRV - Total 8 - All the rest, a total of 22 (twenty two) components are above their respective August 8 lows

Subscribe to:

Post Comments (Atom)

2 comments:

It is hard to believe that the NASDAQ is still in "risk on" mode. The QQQ is barely showing signs of a correction. The action in the NASDAQ this time around is starkly different that that of the 2008 bear market.

August 8 lows are violated in the cash market

Futures are holding the 10 pm low

are you still bullish thinking that this is just a correction of lesser degree and not a bear market?

Post a Comment