In

a Getting Technical market letter - Interim Update December 18, 2013 GT1419 – I

selected two gold stocks to be held for recovery through 2014. They were B2Gold

Corp (BTO) with a price at Dec 17, 2013 of $2.19 and Osisko Mining Corporation

(OSK) with a price at Dec 17, 2013 of $4.65

I

displayed a weekly chart of Osisko Mining Corporation (OSK) that was displaying

several bullish technical signals – a bullish (youthful) weekly cycle and the

important recent higher (October) lows relative to the prior lows of mid 2013. A

higher low in a down trend is important – on a weekly chart – because a higher

low could be a signal of a positive trend change. In other words the brutal end

of December tax loss selling had not sent these names down to new lows.

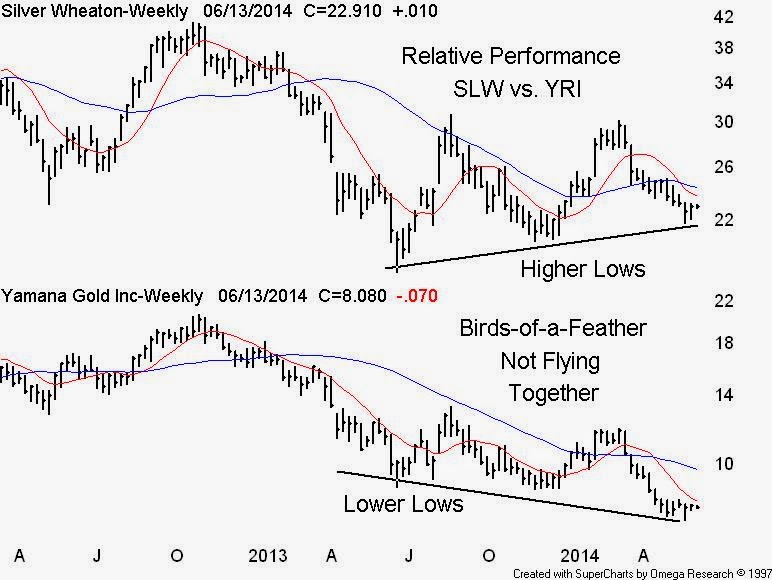

We

can apply the same relative argument today against the gold and silver miners

because although they are birds-of-a-feather many do not fly together as

displayed in our Silver Wheaton vs. Yamana Gold chart – go with the higher

lows. Other lower-low names are Alamos, IAM Gold, Kinross and SilverCorp

2 comments:

When does it make sense to consider the laggards?

Hello

By laggards can I assume the names with the lower lows?

Watch the TSX listed XGD ($10.91) and wait for a move back above the 200 day MA - currently about 11.20 before acting

Bill Carrigan

Post a Comment