The outlook looks bad for Suncor Energy Inc. (SU) with

crude prices at or near 10 year lows and now a Liberal majority in Ottawa. But in reality

Suncor has been a terrible investment ever since the 2009 dead cat rebound from

the 2008 lows.

So much for the fundamentals

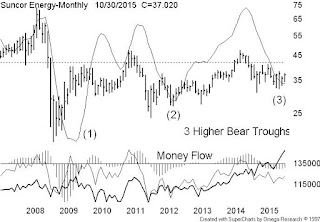

On the technical side – Suncor is beginning to print

a bullish price structure. Our chart is a very long term plot – monthly bars of Suncor

spanning almost ten years which happens to display Suncor’s 2008 – 2015 secular

bear.

No comments:

Post a Comment