I often laugh-out-loud (LOL) when a “portfolio manager” is a guest on a business TV show – be it CNBC, BNN or CBC – they talk fundamental stuff like ROE, the balance sheet, the earnings outlook, the dividend coverage, the book value all “going forward” of course. Then they slip and make a technical comment – “there is support at” or “just over the 50-day” they snap out of it and quickly get back to gross margins.

The only reason I got my CIM designation was because I need to know how these guys think. Basically they all get sucked in by the compelling storeys served to them by the companies they “investigate”. It is not about lying – it is about misinformation or the lack of truth. Do the analysts and the auditors ever really know what those assets are worth? I recall Allen-Vanguard Corp at $10 (now worth nothing) being very focused on Iraq and roadside bombs.- winning contracts and there was great optimism that big sales will continue and big earnings to come. Don’t get me started on Timminco Ltd

As a technician I believe the worst – the companies misinform the auditors, the auditors misinform the banks, the banks pass the misinformation to their analysts who misinform the portfolio managers who get on TV and misinform the viewers.

The bottom line is the smart money always wins – the smart money gets in first and gets out first – you and I will never be the first to know – our only defence to follow the money and ignore those compelling stories

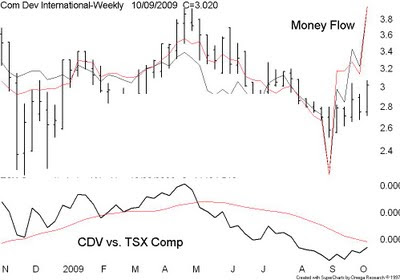

I bought some COM DEV (TSX-CDV) last week because of the soaring money flow numbers – CON DEV is manufacturer and distributor of space communications and space science products – I have no idea of the outlook for the company - only the insiders know that - I am just following the money honey

The only reason I got my CIM designation was because I need to know how these guys think. Basically they all get sucked in by the compelling storeys served to them by the companies they “investigate”. It is not about lying – it is about misinformation or the lack of truth. Do the analysts and the auditors ever really know what those assets are worth? I recall Allen-Vanguard Corp at $10 (now worth nothing) being very focused on Iraq and roadside bombs.- winning contracts and there was great optimism that big sales will continue and big earnings to come. Don’t get me started on Timminco Ltd

As a technician I believe the worst – the companies misinform the auditors, the auditors misinform the banks, the banks pass the misinformation to their analysts who misinform the portfolio managers who get on TV and misinform the viewers.

The bottom line is the smart money always wins – the smart money gets in first and gets out first – you and I will never be the first to know – our only defence to follow the money and ignore those compelling stories

I bought some COM DEV (TSX-CDV) last week because of the soaring money flow numbers – CON DEV is manufacturer and distributor of space communications and space science products – I have no idea of the outlook for the company - only the insiders know that - I am just following the money honey

3 comments:

About fundamental analysis . . . I used to teach accounting but realized finally that I was part of the problem. My favourite class was on earnings management, when the students realized (horrified) that they knew how to pull the wool over people's eyes. Then we had an opportunity to get real about professional ethics.

Bill,

As you stated "smart money always wins". I cannot disagree with that.

In terms of measuring smart money, which money flow indicator do you think works best? Also, isn't the on balance volume also a good indicator of smart money?

Hello LN

The OBV or on-balance-volume is very good way to follow the money

I use a variation of the OBV - keep in mind nothing works all the time

Bill C

Post a Comment