A few blogs ago I suggested that if the price of gold were to break above $1220 the gold producers will benefit from a bullish stampede into the group. If Gold stalls at 1220 we cut and run. Now aside from the Greece fiasco the technical attraction for the gold complex is the price of gold advancing in the face of a rising U.S. dollar. So now with price of gold just at or above the all-time peak set last December 2009 we can over-weight into the gold miners in anticipation of the group also running above the old December 2009 price peak. We do have options here - we could simply acquire the TSX listed iShares Gold ETF (XGD) or we could buy some gold stocks - or do a bit of both.

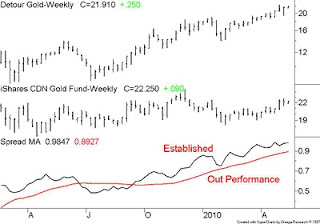

One reasonable option would be to buy the index - the iShares (XGD) and also buy one or two of the stronger names to enhance our returns. A quick relative performance scan solves the problem as we can see in our Detour Gold vs. iShares XGD chart. In this example Detour Gold is a long established sector out performer and so is a candidate to enhance our gold miner returns.

Some of the out perform names are Detour Gold (DGC), Eldorado Gold(ELD), Novagold Resources (NG), New Gold Inc. (NGD) and Red Back (RBI). Some of the under perform avoids are Gammon (GAM), Kinross (K), Vista (VGZ) and Yamana (YRI). The names not mentioned such as Barrick and GoldCorp are sector performers.

Subscribe to:

Post Comments (Atom)

2 comments:

Bill,

Also to consider is HGU-T, the double XGD index etf. I have found that it is usually in the top 5%, in terms of performance, when compared to the intermediate and major gold producers. Choosing HGU-T also cuts down on a lot of the digging around of trying to locate the few out performers in the gold sector.

Hello

Yes the HGU is a good choice if the gold stocks are rising - but if the group corrects the HGU can be nasty

Bill C

Post a Comment